Welcome to one of the most active flamenco sites on the Internet. Guests can read most posts but if you want to participate click here to register.

This site is dedicated to the memory of Paco de Lucía, Ron Mitchell, Guy Williams, Linda Elvira, Philip John Lee, Craig Eros, Ben Woods, David Serva and Tom Blackshear who went ahead of us.

We receive 12,200 visitors a month from 200 countries and 1.7 million page impressions a year. To advertise on this site please contact us.

|

|

|

Taxes, Corruption

|

You are logged in as Guest

|

|

Users viewing this topic: none

|

|

Login  | |

|

Richard Jernigan

Posts: 3430

Joined: Jan. 20 2004

From: Austin, Texas USA

|

Taxes, Corruption Taxes, Corruption

|

|

|

quote:

original: Ruphus

Dear Richard,

I do not think at all that you are stupid, and you know that. Actually I admire your intellectual openess.

However, I presume that unconsciously you don´t allow yourself to fully face the inhuman state.

An apparent psychological self-defence that drives the majority of fellow men.

Unconscious ignorance despite facts, which used to be an anthropological survival factor, now the most destructive phenomenon since men effectively detouched from nature.

A psychological phenomenon further imployed and systematically exploited by feudal and capitalistic condition, which to expound on here would be taking too long.

The above is a 21st Century version of the ad hominem attack. It is not only presumptuous, it is insulting to offer "psychological analysis" of a total stranger. And it is a total evasion of the issues of debate.

Let us return to the issues, and forego the "psychological" insults.

My view of human nature and society probably has more in common with Balinese Hinduism and Japanese Buddhism than Christianity or Marxism. The latter two tend to view the world as starkly divided between good and evil. The former two see the world as a continuum of forces, some more on the side of order and regeneration, other forces tending to degeneration and chaos.

Rather than trying to stamp out evil or attain some ideal state, Balinese Hinduism tries to maintain or restore balance among the two tendencies. At any Balinese ceremony you will see beautiful offerings of flowers, rice and fruit placed in high spots, intended for the gods. You will also see offerings of meat wrapped in dried leaves, and other "low" objects, intended for what the Westerners insist on calling "demons", but which the Balinese call "leyaks", "calarongs" and so on.

The Balinese build their residential compounds with defenses against dangerous forces, but they avoid battle with them, and certainly don't attempt anything as foolish as to stamp them out.

In Japan, the Yakuza, whom Westerners insist of calling "organized crime", are not relentlessly pursued by the police with the objective of totally stamping them out. Nor are they seen as the personification of evil. Instead, they are recognized as embodying certain indelible human characteristics, including the propensity to gamble, to drink, to engage in casual sex for money, and so on. As long as the Yakuza play by the rules and do not trouble the sane citizens, they are more or less left alone.

My Japanese girlfriend thought I had been even more dense than usual when at last I realized that the order and safety of Japanese streets owed more to the Yakuza's ruthless and violent elimination of petty crime than it did to the vigilance of the police.

Of course the Yakuza are always trying to expand their power, and the police are trying to keep them in check. But it is not a fight to the death. It is a struggle to maintain balance.

Similarly, I see no ideal form of human society or economic order. I think none exists. The Manichean demonization of capitalism by Marxist thinkers is not only foolish, it is damaging to society. The capitalist horror of collectivist projects is equally foolish and damaging. The reason is that capitalism and socialism each embodies a part, but only a part, of human nature.

We should not attempt to impose capitalism or socialism. Either attempt leads to tyranny as the enthusiasts try to stamp out the part of human nature perceived and embodied by the opposing philosophy.

Instead we should try to balance the individualist and collectivist tendencies of human nature, allowing neither to attain a tyrannical ascendancy.

The attempt to achieve balance through politics should be the subject of debate, deliberation, compromise and consensus, not the demonization of the opposition and the imposition of ideology. Unfortunately, at present America seems to be partly sunk in a dark age of ideological warfare.

The enthusiastic and wholehearted embrace of religions and political philosophies are also a part of human nature I don't see fading away any time soon. But they shouldn't be allowed to damage the general welfare.

My position is not that American society runs according to capitalist theory--nor should it. The burden of my recent posts is not that America is a capitalist paradise. My message is that fraud is not as rampant as pessimists insist. This is based on more than 40 years of dealing at fairly high levels with business and government.

Yes, fraud and corruption exist. They always will. They are a part of human nature. But in the USA, fraud is kept reasonably well in check.

Yes, there are injustices and abuses of power in American society, some of them serious. These will always exist as well, but I don't think they need be as serious as some are. In my view, the imposition of a purely socialist, or a purely capitalist economic system will not eliminate serious injustice and abuse of power. Many such attempts have continued the abuses of the regimes they replaced, in modified but just as evil form, at times more evil.

Private property and the free market have their values, and in my opinion are an indelible part of human nature. But they should not allow individual initiative to result in tyranny. Collective security and a social safety net are the hallmarks of a civilized society. But they must not be carried to the extreme of attempting to choke out individualism.

---------

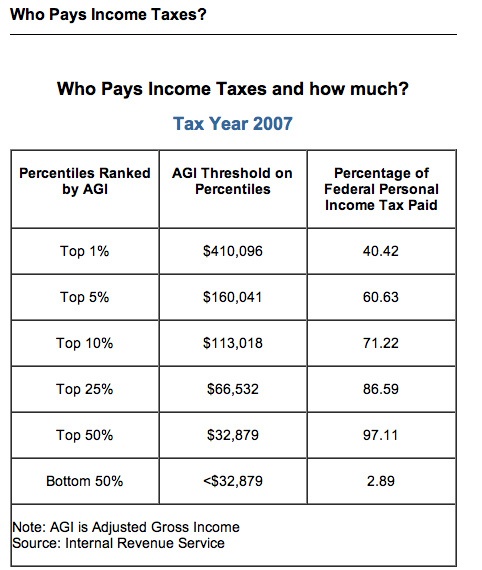

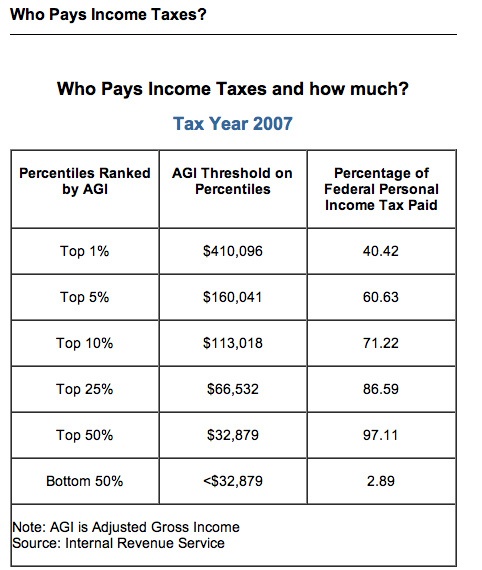

Now to the subject of taxes. Can you see this table of statistics, published by the agency of the US Government which collects income tax? If not, I will transcribe it into text in a subsequent message. It is not a projection. It is a record of taxes collected in 2008 on income for the year 2007. You seem to say that this data is fraudulent. Is that the case? Do you think this is a fraud perpetrated by the government?

Images are resized automatically to a maximum width of 800px

Attachment (1) Attachment (1)

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date May 28 2011 18:19:13

|

|

Ruphus

Posts: 3782

Joined: Nov. 18 2010

|

RE: Taxes, Corruption (in reply to Richard Jernigan) RE: Taxes, Corruption (in reply to Richard Jernigan)

|

|

|

quote:

ORIGINAL: Richard Jernigan

The above is a 21st Century version of the ad hominem attack. It is not only presumptuous, it is insulting to offer "psychological analysis" of a total stranger.

You are too focussed on personal conditions.

There exists scientificially elaborated background for the phenomenon of why human psyche will neglect burdening entity in a common culture like ours.

Should I refrain from mentioning this general and rational possibility in order to avoid potential perceivement of insult?

What, if you like the majority of people were indeed omitting unveiled sight on trivial and fatal evil just for relief of psyche´s strain? Could then not be what must not be?

I have distinctively expressed that there would be no sense for me to try and insult you ( or anyone for that matter ). That was meant sincerely, and you could try considering it.

quote:

ORIGINAL: Richard Jernigan

And it is a total evasion of the issues of debate.

Definitly not.

How could we regard subjective mechanisms of putative psyche defense without illuminating how and why it works?

quote:

ORIGINAL: Richard Jernigan

My view of human nature and society probably has more in common with Balinese Hinduism and Japanese Buddhism than Christianity or Marxism. The latter two tend to view the world as starkly divided between good and evil. The former two see the world as a continuum of forces, some more on the side of order and regeneration, other forces tending to degeneration and chaos.

That is quite a lump of methodically entirely differently based dogmas and thesis.

The first two religions, eventhough of useful guide for individual´s mental balance, are far from scientifical discover of behavioural and material backgrounds.

Christian theology just the same, only far more destructive in that it works all with syncretism, threat and pang in order to tie followers to itself.

Marxism analysis how societal structures are set up to exploit majorities on benefit of minorities. Neither instructing you to personal health and societal passivity, nor threatening you with hell if you won´t follow a votiv.

quote:

ORIGINAL: Richard Jernigan

The reason is that capitalism and socialism each embodies a part, but only a part, of human nature.

...

Yes, fraud and corruption exist. They always will. They are a part of human nature.

The points you make are all about culture.

"Human nature" would imply something genetically provided and only alterable in time scales of 100 000 years ( with humans, as been said ).

The things you mention however are describing and concerning culture. Something alterable within anthropological blink.

And you err wit the assumption that fraud and corruption always exist. That is theological artifact, especially of the Christian dogma.

This misty claim has been indoctrinated into common sense intentionally and resulted in a sturdy myth.

One just can´t ever soberly evaluate human status quo and options on base of such factual nonesense.

quote:

ORIGINAL: Richard Jernigan

The enthusiastic and wholehearted embrace of religions and political philosophies are also a part of human nature I don't see fading away any time soon.

That statement implies no difference between despair and rational impetus.

As the brains operation allows no place-maker, hence MUST interpret even the rationally unknown, superstition inevitably used to be a daily resort in ancient times.

However, it is of no useful function as replacement for objective findings; no reasonable place-maker for information vastly available on daily phenomenons today.

Whether people make use of rational cognition, whether rational education is available and whether it will be made use of, is a question of culture.

Superstition will fade the minute cultural means will have been brought up to date.

There is no inevitable fate as you believe, but what could be happening indeed would be cultural bust.

quote:

ORIGINAL: Richard Jernigan

Private property and the free market have their values, and in my opinion are an indelible part of human nature.

Again, that would be culture.

And free market in the sense of being allowed to squeeze out of consumers and employees as much as pleases has little to do with human being, let alone nature.

Much lesser of `human nature´ is the permission to usurpate surplus value of labour.

That usurpation is the marrow of capitalism and infringement of human right.

People who think capitalism was discussable as humane option are not educated on the fact of that usurpation, and much lesser yet on the ethical fact that labour surplus value is inalienable.

There exists a severe lack on even basic knowledge of ethics.

We definitly need renewal of educational systems.

Without it there will be no future.

quote:

ORIGINAL: Richard Jernigan

You seem to say that this data is fraudulent. Is that the case? Do you think this is a fraud perpetrated by the government?

quote:

ORIGINAL: Ruphus

It´s about time for people to understand that states statistics aren´t the wholy grail of sincerity, but manipulated to desire just like declarations of combines.

The numbers on US tax contributions quoted above obviously are not empirical, but projection on official dues of income groups.

Everyone who regularly reads the papers over a longer period of time, knows from countless reports that official dues have absolutely nothing to do with actual pratice.

True instead is that the higher the income group the more official and unofficial opportunities of bypassing tax there exist.

Any tax consultant with wealthy clients would confirm that to you provided anonymity / trusting you enough.

Practical reality is that near 100% of all levy is being drawn in from mid to low income tax dues and that the upper class including combines pay from near nothing down to in fact taking in subsidies.

In the same time those immediate near 100% actually amount to several hundred and even thousands of % when you consider who will in the long term have to shoulder the states debts.

Ruphus

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date May 29 2011 12:09:46

|

|

Richard Jernigan

Posts: 3430

Joined: Jan. 20 2004

From: Austin, Texas USA

|

RE: Taxes, Corruption (in reply to Ruphus) RE: Taxes, Corruption (in reply to Ruphus)

|

|

|

The earlier part of my previous post was intended to clarify my philosophical position, since you seemed possibly to identify me as a devout capitalist. As such, it was not an invitation to debate. I should have made that clear.

The tax part was an invitation to debate.

quote:

ORIGINAL: Ruphus

quote:

ORIGINAL: Richard Jernigan

The above is a 21st Century version of the ad hominem attack. It is not only presumptuous, it is insulting to offer "psychological analysis" of a total stranger.

You are too focussed on personal conditions.

There exists scientificially elaborated background for the phenomenon of why human psyche will neglect burdening entity in a common culture like ours.

Should I refrain from mentioning this general and rational possibility in order to avoid potential perceivement of insult?

What, if you like the majority of people were indeed omitting unveiled sight on trivial and fatal evil just for relief of psyche´s strain? Could then not be what must not be?

I have distinctively expressed that there would be no sense for me to try and insult you ( or anyone for that matter ). That was meant sincerely, and you could try considering it.

Here's the trouble with that position. Instead of debating the merits of your arguments, I could just say, "Sorry my friend, you are just deluded. Reams of psychological studies, which I will not burden you by citing, show that this is likely the case."

Or are you among that tiny minority who see clearly?

You reassert your claim that governments, presumably including the U.S. Government, routinely defraud the public by publishing grossly falsified statistics on the relative tax burdens of different income groups. You have arrived at this conclusion by reading the newspapers.

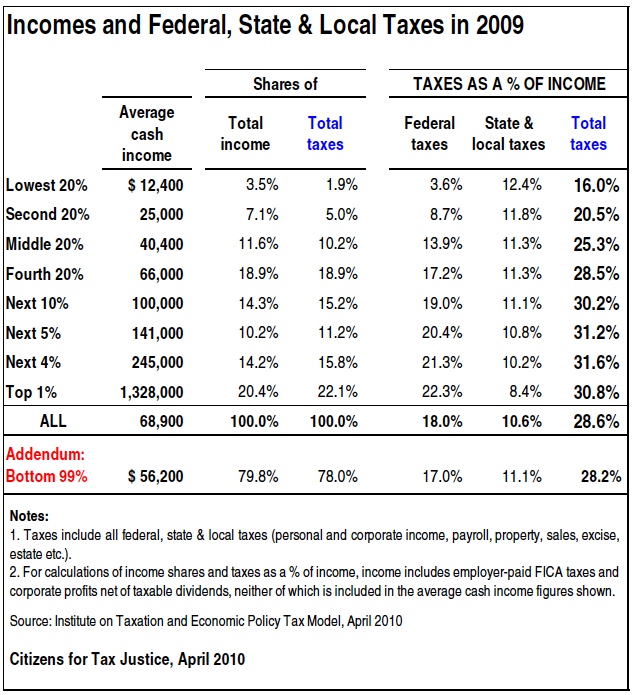

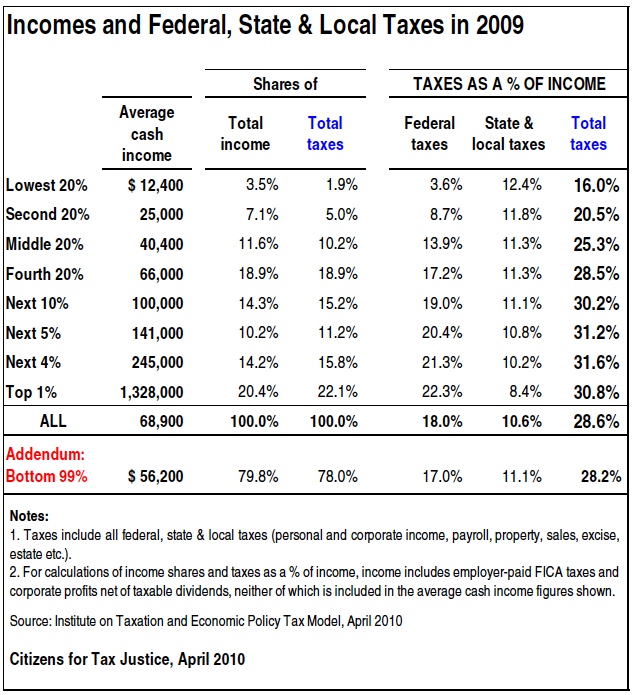

So I adduce another set of data, from the Citizens for Tax Justice (CTJ).

http://www.ctj.org/pdf/taxday2010.pdf

They are a "think tank" devoted to influencing tax policy through analysis and publication of data. It is clear that their agenda is to make the overall tax system more "progressive", that is to shift more of the tax burden onto the wealthier segments of society. Thus they would have no motivation to minimize the contribution of lower income groups, nor to maximize that of higher income groups. You may read and criticize their statistical methods at their web site, unless you are prevented from doing so by the troglodytic regime under which you have chosen to live.

I will summarize from the third column, labeled "Shares of Total taxes": The lower 60% of income earners pay 17.1% of total federal, state and local taxes. The upper 40% of income earners pay the remaining. 82.9% of total taxes. The top 1% of income earners pay 22.1% of total taxes.

State and local tax systems in the U.S.A. are indeed regressive, putting a higher effective tax rate on the lower income taxpayers. But the strongly progressive federal income tax more than counterbalances this. Higher income groups pay a higher percentage of their reported income than do the lower groups. This accounts for all the legal tax breaks enjoyed by the wealthy. This is shown in the rightmost column of the data below. It is shown graphically in the next post..

Let me make a prediction. I predict that you will dismiss both of these data sets, produced by an organization long involved in tax politics, and whose data would be gleefully attacked by their political opponents if there were the slightest chink in their armor. The basis of your dismissal will be your superior knowledge gleaned from reading the newspapers.

And since you insist that "psychological" remarks are to be encouraged, i will assert that you are the one blinded by prejudice. I will never convince you of the actual facts, so I will leave it at that.

RNJ

Images are resized automatically to a maximum width of 800px

Attachment (1) Attachment (1)

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date May 29 2011 21:42:56

|

|

Richard Jernigan

Posts: 3430

Joined: Jan. 20 2004

From: Austin, Texas USA

|

RE: Taxes, Corruption (in reply to Richard Jernigan) RE: Taxes, Corruption (in reply to Richard Jernigan)

|

|

|

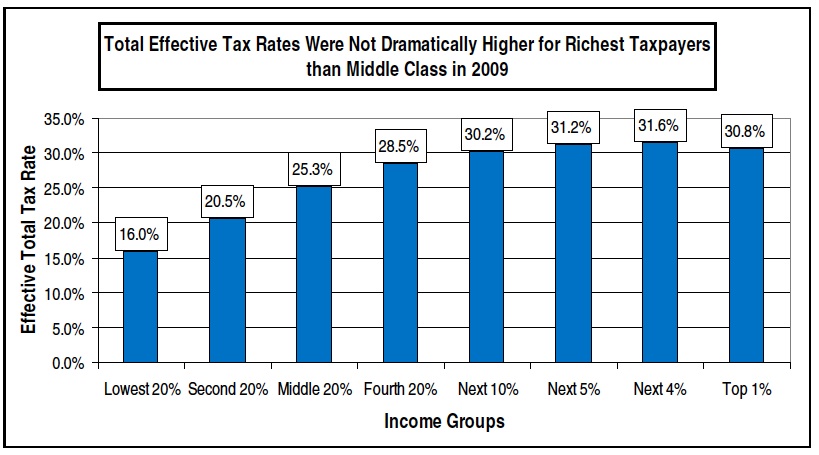

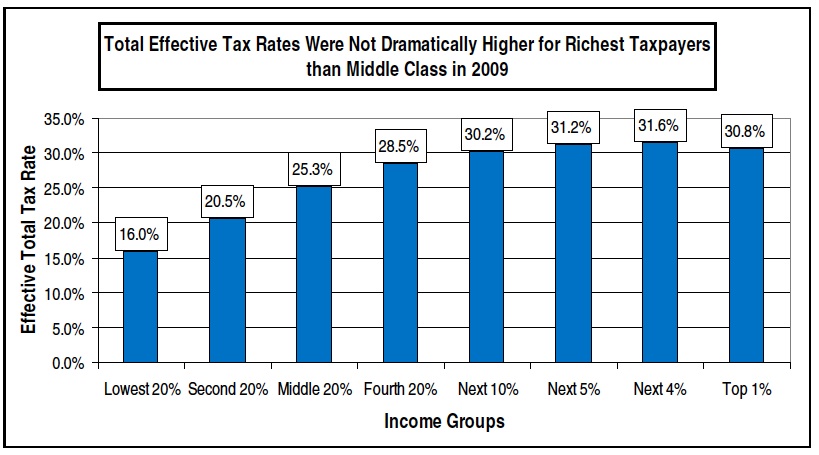

Here is the data promised in the previous post, from the source cited there.

As I said, this accounts for all the legal tax breaks enjoyed by higher income earners.

Concerning fraud, i will say this. Despite the prevalence of fraud in the top 1% of income earners asserted by my daughter the attorney, they still pay 22% of all taxes. The effective tax rate on their reported income is essentially the same as that of the next 39% of earners below them. Why is that? If the effective rate on their reported income were materially below that of others in the upper brackets, they would attract the attention of the Internal Revenue Service auditors. Once you have full access to someone's financial records, it is routine, though possibly laborious, to detect fraud. So they pay an amount of taxes corresponding to their visible lifestyle.

If you assert that people making an average of only $66,000 per year are engaged in massive fraud, I will ask you what you have been smoking. There are dozens of studies showing that people smoking drugs have impaired cognitive abilities--though I won't waste your time by citing a single one--so this is a perfectly legitimate question.

I will now leave you to your deluded slumbers, Ruphus.

Images are resized automatically to a maximum width of 800px

Attachment (1) Attachment (1)

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date May 29 2011 21:55:22

|

|

Ruphus

Posts: 3782

Joined: Nov. 18 2010

|

RE: Taxes, Corruption (in reply to Richard Jernigan) RE: Taxes, Corruption (in reply to Richard Jernigan)

|

|

|

Equalling me with the country I am residing and fancying me smoking something, shows how the idea irks you that you could be unconsciously noticing things only within moderate frames.

Brisk dismiss might not make a potential basis of questioning the possibility at all, however.

But I am glad that common double accounting, donation and bribe exist only occasionally in your great new world.

Me could be crazy with being aware of a fundamental circumstance like appropriated labour surplus value, which as tremendous factor would be rendering pretty much everything from demographic issues to tax levy etc. negligible items anway ...

Or maybe you.

What my supposed lunatic state is concerned, I must ascertain that unfortunately the very most of my estimations of national and global corresponding status quo and developing tendencies over the past decades did realize.

Many of them appearing just as off to the people like now my statement that there exists no democracy sounding to you.

A number of friends who deemed some of the observations as impossible, had to grant me the cup of coffee or whatever symbolic object we had bet on, years afterwards.

Anyway, I don´t really mind about who I or you are supposed to be.

I like what I was allowed to read from you, thinking that you are a nice guy.

But what counts to me is the matter; not so much who of us could be more cognitively vulnerable or smoking the pipe.

I made a quick search on the topic of US tax paying on official playground.

I am sure that there can also be found much more on tax avoiding routines, and likely even explorations on falsified statistics, but I am not going to frisk the internet with an anemic internet connection.

quote:

The Institute on Taxation and Economic Policy found that that the wealthiest 1 percent of Massachusetts residents paid only 4.8 percent of their income in taxes, while 80 percent of middle-and low-income residents paid more than 10 percent of their income. In other words, the burden of financing public services rested primarily on those who could least afford it.

A second component of tax unfairness is that public services are funded largely by the personal income tax. Some defend the top 1 percent of Americans, who pay about a third of all income taxes. But this does not tell the whole story.

Consider tax shelters. Taxpayers in the top 1 percent receive much of their income not from wages but from investments. Capital gains are taxed at a much lower marginal rate. The tax rules on corporate, capital gains, dividend, estate, and interest taxes primarily benefit the economic elites, not working people.

Working people pay taxes on a bigger share of their earnings than the rich. They’re hit more by Social Security taxes, excise levies, and tariffs.

Payroll taxes also unfairly gouge middle- and low-income folks. The employer’s share of the Social Security tax is actually a levy on wages, since employers reduce wages to compensate for that tax. And when property taxes and fuel taxes are included in the equation, it is clear that our tax system is painfully unfair to middle- and low-income people.

http://labornotes.org/2010/10/who-pays-taxes

---------

In the year 2000, at the height of the last economic boom and before the most recent round of tax cuts were enacted, IRS data shows that the richest 400 taxpayers paid 27% of their income in federal, state, and local taxes. On average, these 400 taxpayers each had taxable income of $151 million. All other taxpayers had average taxable income of only $34,600, and yet their tax burden was 40%.

Journalists Donald Barlett and James Steele point out that this inequity results from a political system that has been put up for auction: “Over the last three decades, America’s elected officials have turned a reasonably fair tax code into one crafted for the benefit of those who give the largest campaign contributions, enjoy the greatest access, hire the most influential lobbyists, or otherwise exercise power beyond that enjoyed by average citizens.”

Corporations have been profiting in Washington, too. In 1965, individual taxpayers paid 66% of all US income taxes, and corporations paid about a third. But by 2000, the corporate share had dropped to 18%, just about half what it used to be.

A recent Congressional study reported that 63% of US corporations paid no income taxes at all in 2000. Six in ten American corporations reported no tax liability for the five years from 1996 through 2000, even though corporate profits were growing at record-breaking levels during that period.

BACK TO TOP

The Tax Code Fuels Wealth Concentration

Not since 1929 have so few people controlled so much of the wealth in our country. In his new book, Perfectly Legal, New York Times reporter David Cay Johnston reports that between 1970 and 2000 average income for the top 13,400 households in America increased from $3.6 million to nearly $24 million. That’s a staggering 538% increase. At the same time, the average income for 90% of US households actually fell from $27,060 to $27,035. These 13,400 households account for just .01% of the population, according to Johnston.

Income distribution in the United States is the most unequal among all developed nations, according to OECD data.

Prosperity that was supposed to ‘trickle down’ has instead flowed straight uphill. Between 1990 and 2000, the average CEO pay went up by 571% and corporate profits grew by 93% while worker pay barely stayed ahead of inflation.

BACK TO TOP

The Inherent Unfairness of Income Taxes

Investors pay lower income taxes than workers. Roughly 85% of stock market wealth is owned by 10% of American households and there is no logical reason why income from those investments (called “capital gains” by the tax code) should be taxed less than income from work. But the top tax rate on wages is 35% while the top tax rate on capital gains is only 15%. This rate structure gives the richest households enormous advantages without producing any obvious social benefit. If we reversed the favor – and let workers pay lower tax rates than investors – then working families might have greater opportunity to accumulate wealth.

Historians point out that more people moved up into the middle class during the 1950s and 1960s – and American wealth was much less concentrated – when the top income tax rate was 91%, impacting salaries and capital gains equally. According to IRS data for 2000, most American households earned 70% of their income from work and only 10% from capital gains. But in the highest tax brackets, the situation is completely reversed.

Eliminating the special rate for capital gains taxes would reverse a major inequity in the current income tax. And we could reduce rampant under-reporting of capital gains income by instituting automatic withholding, just as we do with salaries.

BACK TO TOP

The Estate Tax Gets a Death Sentence

The Federal Estate tax is the only tax that directly combats the problem of excessive wealth accumulation. Public investments provide American entrepreneurs with a literate work force, court-enforced property laws, and a stable business environment, among many other benefits. The estate tax recaptures some of those investments and makes them available to future generations. Oftentimes, the assets in an estate have never been taxed.

In 2000, only 52,000 estates out of over 2 million deaths that year were large enough to pay estate taxes . Even though the heirs of rich families kept 75% to 80% of their family’s fortunes, the tax generated vast sums for the government. According to the analysts at United for a Fair Economy, “In 2000, the estate tax alone raised more than double the total amount of federal income taxes paid by the bottom half of American taxpayers.” And yet the tax is slated for extinction by President Bush.

Analysts across the political spectrum recommend keeping the estate tax. And dozens of wealthy individuals are actively working to reform but retain the estate tax, including Bill Gates Senior who is father to the world's richest man, and Warren Buffett, who owns the world's second-largest private fortune. Gates has recommended earmarking the proceeds for public investments, like education, that create broad-based economic opportunities.

BACK TO TOP

Social Security Taxes Subsidize Income Tax Cuts

The government collects more Social Security taxes than it needs for current benefits, and yet we face enormous shortfalls when the Baby Boomers retire. David Cay Johnston reports, “From 1984 to 2002, the government collected $1.7 trillion more in Social Security taxes than the agency paid out in benefits to retirees, widows, orphans, and in disability benefits. Instead of investing that surplus to pay for the looming retirement of baby boomers, as promised, that money was used to pay the ordinary bills of the government, making up for the taxes that were no longer being paid by the rich because of the 1981 tax cuts created by Ronald Reagan.

The only way that the taxes Americans have paid in advance for their Social Security benefits can be turned into retirement checks is by a new round of taxes.” Because their money is gone now, “People have lost not just what they paid, but the opportunity to invest the money for themselves.”

Three quarters of US households pay more Social Security taxes than income taxes. Employers deduct the tax straight out of paychecks and send the money directly to the Federal government. A middle-income household pays 9.6% of its income in social security taxes, while households in the top 1% of income pay less than 2%.

Social Security tax rates have increased since 1980, while income tax rates have been cut repeatedly.

During the last presidential campaign, both candidates promised not to spend the Social Security surplus. And candidate Bush specifically promised not to use the surplus to finance tax cuts. But as Johnston reports, that’s just what he did: “In June 2001, President Bush signed his tax cut package that lowered rates on the rich, eliminated the estate tax for one year, and gave more than half of the $1.3 trillion tax cut to the richest 1% of taxpayers. It was a tax cut that also promised years of budget deficits . . . and more raiding of Social Security so that the middle class could subsidize the rich.”

The Social Security tax only applies to income up to $87,000 and people earning above that ceiling get a break from paying the tax.

Refunding excess Social Security payments now will not repair the damages already done. But we could fix the Social Security system by taxing all salaries equally – even salaries over $87,000 that are currently exempt from the tax – and by investing the funds in real assets, not government IOUs.

BACK TO TOP

States Raise Taxes to Compensate for Federal Cuts

When Congress cuts Federal income and estate taxes it ends up sending less money to the states, and each state has to make up the lost revenue somehow. And most states have responded by increasing their sales and excise taxes, or by cutting essential programs, or both. Many states have also cut taxes for their best-off residents. As a result, people in every state are losing libraries, childcare centers and fire stations, while paying bigger bus fares, bridge tolls and sales taxes.

The federal income tax which made up 11% of GDP in 1965, now consumes under 9% of our national income. Total taxes increased from 25% of GDP to 29% during those years, according to data from the Office of Management and Budgets (OMB), but the burden has shifted from the national government to the states.

States rely on regressive taxes, like sales taxes, car taxes and property taxes. Because they impact everyone, regardless of ability to pay, these taxes take a bigger bite from modest incomes than huge fortunes, even if the rich folks own very expensive property or buy more expensive goods.

Because state and local taxes are regressive, as one study recently reported, “Only four states require their best-off citizens to pay as much of their incomes in taxes as middle-income families have to pay.” Therefore, when we shift taxes from the national government to the states, we are once again shifting the burden from wealthy people to poor and middle class people.

The Bush budget for 2005 cuts another $6 billion in federal support to states, and yet public investment in education, job training, child care, the environment, energy, and research is already less than half what it was during the 1960s and 1970s.

Raising taxes and collecting more revenue at the national level – and then passing the resources back to the states – would greatly increase tax equity in America.

BACK TO TOP

Fraud Costs More Than Medicare

“If tax dodging were a business, it would be the nation’s largest corporation,” said journalists Barlett and Steele. The current $311 billion tax gap is the equivalent of the total income taxes paid annually by all individuals and families earning less than $75,000.

If we simply collected taxes that cheaters are withholding from the system, we would have enough to give a free college education to every child in America, or to provide health insurance for small business employees, or to cut social security taxes in half. It amounts to more money than we spent for Medicare in 2003, almost as much as the Defense budget, and almost enough to pay last year’s deficit.

Large corporations and rich individuals have greater incentive and many more opportunities to cheat – by understating income or shipping money to foreign tax havens, by inflating deductions or claiming expenses that never existed, or by speculating in the stock market and then not reporting the gains. People with a job or a pension have no similar opportunity to lie about income or evade taxes.

Unfortunately, as their biggest donors turned into the biggest tax cheaters, politicians have reacted by handcuffing the tax police. Congress has consistently under-funded IRS enforcement efforts and computer upgrades that would catch more tax dodgers.

Congressional misdirection of IRS resources is even worse than their failure to properly fund the agency. Statistics cited by Johnston show that the IRS polices the poor more than the rich, even though the rich have greater opportunity and incentive to cheat.

Corporate tax dodgers get off easy, too: in 2002, the IRS assessed just 22 penalties against corporations, a decline of more than 99% from 1993 when 2,400 penalties were imposed. Audits of corporate returns fell sharply from 26 per 1000 returns in 1997, to only 7 audits per 1000 returns in 2003.

The independent IRS Oversight Board recommends beefing up the IRS enforcement budget, targeting the biggest cheaters first (not the smaller ones), and modernizing or automating more of the IRS enforcement systems. Others have also suggested de-criminalizing tax fraud, arguing that we can catch more people – and recapture more revenue – if the penalty is a fine instead of jail.

BACK TO TOP

Corporate Tax Incentives Fail to Deliver

Corporate tax incentives have been used in the past to encourage socially valuable behavior, like locating a factory in an inner city, for example, or cleaning up pollution levels. But with corporate taxes already at their lowest levels in history, there is very little room left for further incentives. In 2000, only 8% (of more than 27 million American businesses that filed tax returns) were subject to the corporate income tax.

Current tax law favors the wrong kind of corporate behavior. Global companies can park assets overseas, for example, and evade taxes that smaller, local companies still have to pay. Corporations can also justify excessive CEO compensation and executive perks (like private jets) because the tax code makes those expenses tax deductible. Economists argue that the current tax code encourages waste and fraudulent accounting.

Some claim that expensive US income taxes give advantages to foreign corporations who pay less tax in their home countries, but the evidence does not support this claim. Total federal and state corporate income taxes in the US were less than the average for other developed countries.

Corporate taxes that were common in earlier generations have quietly dropped from public discussion. War profits taxes, for example, were once widely used to offset the costs of war, to share the sacrifices fairly among foot soldiers and financiers, and to prevent outright profiteering.

Special windfall profit taxes were levied against companies in the past when an unfair business advantage resulted from unusual circumstances. For instance, when the Arab oil cartel (OPEC) hiked the world oil prices in 1973, the US government initially responded by setting price controls on American crude oil, but then switched to a windfall profits tax. The proceeds were earmarked for energy conservation research.

Both candidates talk about corporate tax incentives, but before we consider additional tax breaks for corporations, we should evaluate the effectiveness of existing programs. Are we keeping jobs where we want them? Are we encouraging openness with shareholders and employees? Are we rewarding efficiency?

Many analysts recommend reducing corporate tax evasion, closing loopholes, and increasing economic efficiency by making corporations pay taxes on the income they report to stockholders, not a separate figure cooked up for the IRS. Another recommendation: boost IRS audit rates for companies that use aggressive tax avoidance tactics.

http://www.askquestions.org/articles/taxes/

---------------------

Still on a national basis, large corporations pay less than 8% of the revenue and they get all the funding and breaks.

http://my.firedoglake.com/perris/2009/03/07/the-middle-class-actually-pays-progressively-more-in-taxes-then-the-wealthy/

---

Traditionally, the top 1% earners earn around 15% of all individual income and pay around 35% of total income tax. The top 10% earn about 37% of all individual income and pay 67% of taxes, while the next 10% earn about 10% of all income and pay about 15% of all income taxes. The remaining 80% earn about 48% of all income and pay 18% of income tax. in fact, the lowest 10% earners earn about 4% of all income and get paid 1% of federal taxes in addition.

These figures suggest that the burden falls largely on the very high income earners, and it is they only who pay most of the taxes and therefore run the economy. The reality is very different. The theory of tax incidence suggests that actually the burden of taxation is very often shared by those who do not actually pay it themselves.

Let us begin with social security taxes. Even if they are paid by the employer, the burden falls largely on the employees, as the employer can pay only as much in the end. In fact if you add social security payments, all the above figures will change. Then top 1% pay only 23% of tax, top 10% pay less than 50% and the poorest 10% pay 1% of all federal tax (out of their share of 4% of all income).

Take into account other minor taxes, situation will look more different, but wait, the real climax is yet to come. Every penny paid by the rich also falls in some way on the poor not directly paying the tax.

Let us begin now with corporate tax. It is not paid by companies, because in reality, companies do not exist - they are just a fiction. The actual tax is paid by people like you and me. It is not even paid by the shareholders, because the tax is levied on all companies, so all companies accommodate it in their pricing and it is ultimately borne by you and me and all others who buy that company's products.

http://www.helium.com/items/1583593-who-bear-the-tax-burden-tax-burden-who-pays-maximum-tax-income-tax-economics-of-taxation-tax

-

Lets say I decide to open Company A that mines mineral X and my unit cost is $10 per. I then sell to my off-shore Company B (probably only on paper) for $9 per unit and therefore report a loss. No tax. Then my offshore Company B sells it back to my domestic distribution firm, Company C, for $110 per unit which then sells it at $100 per unit. Again no tax because Company C also is operating at a loss (of $10 per unit). I am paying no tax even though bottom line is I am making $90 per unit (and probably all before my units of mineral X have left the shipping dock at Company A). But if I play my cards right, I can get extra subsidies and money from the government for things like job creation, offset my "losses", offset my costs of exploration for more mineral X, perhaps get some cash for keeping the environment clean, etc. Nothing really new here.

http://www.sciencechatforum.com/viewtopic.php?f=53&t=17692

-----

While General Electric is one of the most skilled at reducing its tax burden, many other companies have become better at this as well. Although the top corporate tax rate in the United States is 35 percent, one of the highest in the world, companies have been increasingly using a maze of shelters, tax credits and subsidies to pay far less.

In a regulatory filing just a week before the Japanese disaster put a spotlight on the company’s nuclear reactor business, G.E. reported that its tax burden was 7.4 percent of its American profits, about a third of the average reported by other American multinationals. Even those figures are overstated, because they include taxes that will be paid only if the company brings its overseas profits back to the United States. With those profits still offshore, G.E. is effectively getting money back.

Such strategies, as well as changes in tax laws that encouraged some businesses and professionals to file as individuals, have pushed down the corporate share of the nation’s tax receipts — from 30 percent of all federal revenue in the mid-1950s to 6.6 percent in 2009.

...

The assortment of tax breaks G.E. has won in Washington has provided a significant short-term gain for the company’s executives and shareholders. While the financial crisis led G.E. to post a loss in the United States in 2009, regulatory filings show that in the last five years, G.E. has accumulated $26 billion in American profits, and received a net tax benefit from the I.R.S. of $4.1 billion.

http://www.nytimes.com/2011/03/25/business/economy/25tax.html?_r=1&hp

-

Wal-Mart pays very little taxes as well and they are the single biggest contributor to the Republican Party so take your pick of which party is more in bed with the corporations.Probably evenly split.

http://www.amazon.com/forum/politics/Tx2G5AIFTA4TKN9/176-2353716-1660610

Ruphus

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date May 30 2011 21:31:40

|

|

Richard Jernigan

Posts: 3430

Joined: Jan. 20 2004

From: Austin, Texas USA

|

RE: Taxes, Corruption (in reply to Ruphus) RE: Taxes, Corruption (in reply to Ruphus)

|

|

|

quote:

ORIGINAL: Ruphus

Equalling me with the country I am residing and fancying me smoking something, shows how the idea irks you that you could be unconsciously noticing things only within moderate frames.

Thus says the omniscient Ruphus. I was just giving you a dose of your own medicine with an ad hominem attack. What irks me is your pretense of diagnosing my mental state through clairvoyance.

quote:

Brisk dismiss might not make a potential basis of questioning the possibility at all, however.

But I am glad that common double accounting, donation and bribe exist only occasionally in your great new world.

Me could be crazy with being aware of a fundamental circumstance like appropriated labour surplus value, which as tremendous factor would be rendering pretty much everything from demographic issues to tax levy etc. negligible items anway ...

Or maybe you.

What my supposed lunatic state is concerned, I must ascertain that unfortunately the very most of my estimations of national and global corresponding status quo and developing tendencies over the past decades did realize.

Many of them appearing just as off to the people like now my statement that there exists no democracy sounding to you.

Congratulations on your prophetic wisdom. It somehow seems to have escaped my attention.

I don't recall ever having discussed the existence or non-existence of democracy on this or any other public forum. Once again you are relying on clairvoyance, the belief that you have extra-sensory perception, or some other delusion.

quote:

A number of friends who deemed some of the observations as impossible, had to grant me the cup of coffee or whatever symbolic object we had bet on, years afterwards.

Anyway, I don´t really mind about who I or you are supposed to be.

I like what I was allowed to read from you, thinking that you are a nice guy.

But what counts to me is the matter; not so much who of us could be more cognitively vulnerable or smoking the pipe.

I made a quick search on the topic of US tax paying on official playground.

I am sure that there can also be found much more on tax avoiding routines,

Note that "tax avoidance" is the reduction of one's tax liability in accordance with published law. Whether you agree with the law is another matter.

quote:

and likely even explorations on falsified statistics, but I am not going to frisk the internet with an anemic internet connection.

I will do the search for you. Putting "tax fraud statistics" into Google pops up the first response as this Wikipedia article:

http://en.wikipedia.org/wiki/Tax_avoidance_and_tax_evasion#cite_note-8

Clicking on "statistics" in the Wikipedia article takes you to a section including references to two studies. One study estimates the statistics for 2001. The second

http://ideas.repec.org/p/pra/mprapa/29672.html

is more up to date, coming up to 2008. Here is the abstract:

"Abstract This study empirically investigates the extent of non compliance with the tax code and the determinants of federal income tax evasion in the U.S. Employing the most recent data we find that 18-19% of total reportable income is not properly reported to the IRS, giving rise to a “tax gap” approaching $500 billion dollars. Three time periods are studied, 1960-2008, 1970-2008, and 1980-2008. It is found across study periods that income tax evasion is an increasing function of the average effective federal income tax rate, the unemployment rate, public dissatisfaction with government, and per capita real GDP (adopted as a measure of income), and a decreasing function of the Tax Reform Act of 1986 (during its first two years of being implemented). Modest evidence of a negative impact of IRS audit rates on tax evasion is also detected."

This article

http://en.wikipedia.org/wiki/United_States_federal_budget

gives 2008 U.S. tax revenue as $2.5-trillion. Thus 1/6 of what ought to have been collected was fraudulently evaded. The last sentence of the abstract above implies that U.S. tax compliance is largely voluntary. Draw your own conclusions.

Ooops! It now occurs to me that you must be talking about false tax statistics published by the government, one of your fervent beliefs, based on reading the newspapers. I read the newspapers pretty regularly here in the U.S. I don't recall seeing a single article in the last 50 years about fraudulent government tax statistics. They must be doing a really good job of fooling the public, the press, and both political parties. A Google search on "falsification of tax statistics U.S." or "false tax statistics U.S." turns up nothing about fraud by the government in the first 7 pages of either search. I guess we will just have to take your word for it.

quote:

quote:

The Institute on Taxation and Economic Policy found that that the wealthiest 1 percent of Massachusetts residents paid only 4.8 percent of their income in taxes, while 80 percent of middle-and low-income residents paid more than 10 percent of their income. In other words, the burden of financing public services rested primarily on those who could least afford it.

Please pay attention.

1) The Institute on Taxation and Economic Policy is the sister organization of Citizens for Tax Justice, the source I cited in my last two posts. It is the data produced by ITEP that the CTJ presented.

2) I said that state and local tax systems are regressive. Remember, the words "regressive" (higher income groups don't pay a higher percentage of taxes) and "progressive" (higher income groups pay a higher percentage of their income) are technical terms in tax terminology. Value judgments are provided externally. I happen to favor a progressive system.

3) Labor Notes appears to have deceptively picked the Massachusetts regressive state tax system in isolation as an example of unfairness to lower income groups. In fact, in Massachusetts, as nationwide, the strongly progressive Federal income tax more than counterbalances the regressive state tax systems, resulting in an overall system which is progressive. This is illustrated with ITEP's own figures in the table in my post Date May 29 2011 22:42:56. As income increases the percentage of total income paid to state and local taxes decreases, but the percentage paid in federal taxes increaases, overbalancing the regressive state and local taxes. This is shown graphically in my next post.

4) Nationwide the top 40% of reported incomes pay 30.5% of their reported income in total state and federal taxes. The bottom 20% pay 16%. As a fraction of reported income, the top 40% pay 1.9 times as much as the lowest 20%.

5) The bottom 60% pay 20.6% of their income in taxes. As a fraction of income, the top 40% pay 1.5 times as much as the lower 60%. This is progressive.

6) In actual dollar amount, the upper 40% pay 4.45 times as much as the lower 60%. This refutes your assertion that the great majority of tax is collected from poorer people.

All this is from the CTJ, who get their data from the ITEP. It is the data presented in my two previous posts. Both organizations clearly favor a more progressive tax system than the progressive one we already have.

LaborNotes deceptively picks less than 1/100 of the nationwide data presented by CTJ, using the regressive state and local tax system of Massachusetts, presenting a completely distorted picture, intentionally slanted for political purposes.

I never said the tax system was fair. I just disputed your assertion that the vast majority of taxes was collected from the lower income segment of society. If you would pay attention to the quality of data you present, you might learn something, much as it goes against your preconceived notions.

Fairness is a value judgment, strongly influenced by political philosophy. Your political philosophy appears to me to be closely related to doctrinaire Marxism. Mine is a pragmatic mixture of capitalism and socialism. We will never agree on political philosophy, nor likely on the fairness of a tax system.

The U.S. tax code is complex, the result of many competing interests. But the personal taxes paid by individuals is progressive, not strongly regressive as you assert, and as falsely portrayed by LaborNotes.

....and so on.

RNJ

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date May 31 2011 0:08:40

|

|

Ruphus

Posts: 3782

Joined: Nov. 18 2010

|

RE: Taxes, Corruption (in reply to Richard Jernigan) RE: Taxes, Corruption (in reply to Richard Jernigan)

|

|

|

All sounding very conclusive and demonstrating your respectable ability to concentrate on a matter.

Only what is missing is associative skills beyond commonly offered ground.

Apparently, in the papers you read there must have been no mentioning of US administration conceals during those 50 years.

There have been plenty that were only reveiled many years afterwards ( or only through foreign sources ). In fact US administrations repeatedly managed the miracle to keep tight on secrets, even if involved tenth of thousands of people. ( And I really wonder how they do that.)

From foreign instigations, over war crimes like in Vietnam, Iraq or Kuweit, through military experiments like purposeful exposing of US soldiers to nuclear radiation during A-bomb experiments in Nevada, to secret experiments with chemical and biological weapons ( and again calculated exposure to own soldiers in war fields ) or industrial spionage, etc.

Seeing pretty firm ways of enclosure, it would appear very unlikely that there existet obstruction to manipulate statistics to demand, the more as with the little of staff it needs to do so in final instance.

As an example for how freely statistics are being manipulated I like to point to Germany´s office of stats and how it quotes inflation. ( If there be a difference it would certainly not be that German adminstration was more air tight or hollow than the US one.)

Those numbers quoted there are sheer cynism for everyone who actually wittnessed the currencys buying power development.

Alone in 2001 with the introduction of the euro everyone in the trade took the opportunity to increase prices, resulting in a rate between 30 to 100% ( depending on class of goods ). The stats office however decided to reckon a one-digit rate of 3% or so. And similar play down has been typical for all years of the past decades, except for out of all the seventies where they cite some 7% or so, whilst in fact the seventies had the lowest inflation rates down to even zero.

States down playing of inflation serves employers to keep negotion base with unions regressive, just to remember who acts on whose interest.

With no scruples to distort statistics on something as obvious like inflation, one can deduce the general ethical commitment / measure of scruples behind official statistics.

But even if we for some irrational reason consider the US statistics on tax levy as scrupulously recorded:

If you want to estimate tax comppound you need to take into consideration actual profits made, returns, and subsidies taken in.

And you need to take into consideration all the taxation after income tax, and see in how far these effect whom.

With these substantials taken into account the funny statistics will turn upside-down.

And how could it not be the case.

Why should the caste who sets up the state; a caste that has been witty enough to set up indirect voting and restrict parties that will play a controversy show exclusively within trivial frame, stictly outflanking the fundament of democracy like direct voting and inalienable labour surplus value ...

Why should an upper caste establish a state that could be calling themselves into play?

Should paradox be occuring, simply for our peace of mind and wishful thinking?

In all of the self-conducting processes there only come up isolated and rare exceptions once in a while, which excite me just as much as they are making me wonder.

For instance the question how came the US jurisdication that allows citizens to succeed against industrial titans, from individuals and groups gaining their appropriate right up to hillariously over proportioned compensations.

It took me years wondering how industrial interests could be subordinated against individual´s claims, out of all in the US.

... Until the day that I realized that it was another industry behind the phenomenon. The US American lawyer guild.

It is their outrageous shares that pushed and arranged the proportions.

Currently, I am much more bewildered by another phenomenon.

That is Götz Werner´s suggestion for unconditioned base income in Germany.

His congruent outline has even won advocates or at least serious consideration among some established politics.

This is really spektacular, and you might take it as an argument for your belief in probity of establishment while I remain sympathetically puzzled.

Ruphus

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date May 31 2011 14:15:32

|

|

Richard Jernigan

Posts: 3430

Joined: Jan. 20 2004

From: Austin, Texas USA

|

RE: Taxes, Corruption (in reply to Ruphus) RE: Taxes, Corruption (in reply to Ruphus)

|

|

|

quote:

ORIGINAL: Ruphus

All sounding very conclusive and demonstrating your respectable ability to concentrate on a matter.

Only what is missing is associative skills beyond commonly offered ground.

Once again you resort to insult. Of course you believe you see things more clearly than I do. Of course I believe I see things more clearly than you do. Otherwise we wouldn't be going round and round here. But were you never taught how utterly, unredeemably rude it is to display intellectual arrogance?

quote:

Apparently, in the papers you read there must have been no mentioning of US administration conceals during those 50 years.

I said I had never seen anything about fraudulent tax statistics. You immediately commit a giant leap of fantasy to the conclusion that there has been no mention of US government malfeasance in the New York Times, the Washington Post, The Los Angeles Times, El Universal (Mexico, used to carry more on US foreign policy than any US paper), The Daily Telegraph, The Guardian, or Le Monde.

quote:

There have been plenty that were only reveiled many years afterwards ( or only through foreign sources ). In fact US administrations repeatedly managed the miracle to keep tight on secrets, even if involved tenth of thousands of people. ( And I really wonder how they do that.)

My experience has been just the opposite. Over more than four decades of work in the US "defense" business, I held the highest security clearance, and many intelligence access "tickets". I worked on "black" projects, where access to information was formally limited only to those directly involved in the work. I repeatedly saw news in open sources about projects classified at the highest levels of secrecy.

One of my favorite recollections is sitting in a large room where the discussion, at the highest level of security, was the analysis of signals from the giant Soviet anti-missile radar just then discovered at Pushkino, northeast of Moscow. A British accented voice from the back of the room said, "I say, it's nice to see these signals. You know, last month we got the "Searchlight". The week after we saw the photo in the New York Times." ("Searchlight" is a message notifying recipients of urgent intelligent information, classified at the highest level.)

Another example was The New York Times breaking the story of illegal surveillance of US citizens' communications by the National Security Agency, instituted after 9/11. The Times sat on the story for a year, at the personal request of President Bush. Then they decided it was too important not to publish.

quote:

From foreign instigations, over war crimes like in Vietnam, Iraq or Kuweit, through military experiments like purposeful exposing of US soldiers to nuclear radiation during A-bomb experiments in Nevada, to secret experiments with chemical and biological weapons ( and again calculated exposure to own soldiers in war fields ) or industrial spionage, etc.

I can extend your list. When my father would grow frustrated with the military bureaucracy in Washington DC, he would announce ironically at the dinner table, that he would depart the US to be a general in the United Fruit Company army in Honduras. Before I was out of high school, the CIA had deposed the legitimately elected government of Jacobo Arbenz in Guatemala.

Not long after, through ineptitude and capitalist fear, we drove the socialist revolution of Cuba into the arms of the Soviets, though Castro had made overtures of friendship to the US. This led to lasting enmity, and during the Cuban Missile Crisis, it nearly led to thermonuclear holocaust.

Subsequently we deposed the legitimately elected Salvador Allende in Chile, and installed the fascist dictator Pinochet, with far more fatal consequences. We supported Los Gorilas in Argentina, who "disappeared" hundreds, likely thousands. Misinterpreting our support, they started the Falklands War.

Turning to the Middle East, also while I was still in high school, we and the British deposed the democratically elected Mossadegh in Iran, and installed the Shah as our puppet. This led directly to the present Islamic Republic, after 26 years of increasingly oppressive autocratic rule.

During the Iran-Iraq war we supported Saddam Hussein of Iraq against the Iranian adversary we had created for ourselves. To the great surprise of the geniuses of US policy, Saddam soon turned against us as well.

In Vietnam we escalated the war on the grounds of the phony "Gulf of Tonkin incident." We engineered the overthrow of Ngo Dinh Diem, who did not perform to our expectations. However we expressed shock and horror at his assassination at the hands of our lackeys. They were just supposed to depose him. Ngo's successor Nguyen Cao Ky proved just as corrupt and ineffective. After we lost the war, we brought Nguyen to the US. To our great surprise, he turned out to be just as big a gangster in the US as he had been in Vietnam.

The My Lai Massacre was the only one publicly prosecuted, but it was generally known that it was only the tip of the iceberg.

During the war, Nixon lied about bombing Laos. He lied about invading Cambodia. He lied about his "secret plan" to end the war. He lied about his participation in the planning and attempted coverup of the Watergate burglary. He lied about his misuse of the CIA and the NSA against his enemies. On the grounds of these last two offenses, we crucified Nixon to atone for our sins.

In sum, the US behaved badly, as had all recent world powers such as Britain, Germany and the Soviet Union. But all this was reported in the US press with reasonable promptness. All of it.

But never a whisper about the Internal Revenue Service. Why was this?

Up close, evil often appears banal and ordinary. Life goes on. Any citizen of the world powers mentioned above will testify to that. Things went along okay until catastrophe intervened.

As evil as much of US behavior has been on he world stage (not all of it), the bureaucracy of the US government is made up almost entirely of good, honest, well meaning people--just like the "good Germans" of the Nazi era, the heroes of Soviet Labor of the Stalin era, the loyal subjects of the Monarchy during the expansion of British colonialism. None of these powers would have achieved world status without a solid, reliable bureaucracy of honest hardworking people.

A very different sort of bureaucracy exists in much of the world. I was offered a job in Brazil by Raytheon, part of a billion-dollar project funded by the US and European countries. My job would have been to install 3/4-billion dollars' worth of air traffic control and environmental monitoring equipment in the Amazon. Discussing the possibility with the American boss in Brazil, I asked how relations with the Brazilian government would be handled.

"That is my job," he replied.

"Of course," I said. I went on to mention that I had spent a fair amount of time in Latin America. I told an amusing story of the US Consul in Merida, Yucatan being shaken down for bribes by the local Immigration Chief, over the Consul's Spanish mother-in-law. Mexico didn't recognize the Franco government of Spain.

I was concerned that Raytheon, with little experience in Latin America, might approach the situation with too much naivete. I thought the American boss got my drift but he didn't answer.

A few days later, I asked the American boss whether I would spend much time at the Rio de Janeiro office, attractively close to the beautiful beaches--and beautiful girls--of the Zona Sul. He took the opportunity to answer my previous question.

"You won't find many Americans at that office." He gave a fairly long list of family names of wealthy and powerful Brazilians. "And those people will be out of the office most of the time, on 'other business.' "

"I see. Well that clears up one of my concerns." Though the job paid more than I was making at the time, it sounded to me like the project was already behind schedule and over budget. Besides, Manaus didn't seem all that attractive to me, so I turned it down.

But in more than 40 years I came across only a handful of improprieties in the "defense" bureaucracy of the US. All were promptly detected, prosecuted and reported in the press.

But never a whisper about the IRS cooking the statistics of tax collection. I tend pretty strongly to believe them. For 2007 they are published here

http://www.irs.gov/pub/irs-soi/07inalcr.pdf

in a 188-pqge .pdf file. The statistics for the table in my post Date May 28 2011 19:19:13 are in Table 1.1, pages 31-35, among a mountain of other data. In addition, the page orientation makes it hard to see a whole page at a time, and the Mac version of Adobe Reader doesn't have a readily obvious page rotation feature. When I have the time, i will print out the table. I hope it doesn't give the lie to the one I posted on Date May 28 2011 19:19:13 . I'm pretty confident it will back up the table from CTJ. My recent reading indicates they have a solid reputation.

Ruphus, I have enjoyed this discussion with you. We will never agree on this subject. Our experience , thinking and philosophy are too different. But I have mostly enjoyed the discussion, and I have learned a bit looking up stuff to support my position.

I see that you were not offended by my pulling your leg about smoking dope. It was intended as an obvious parody of your suggestion, then allegation of my defective thought processes. Instead of getting the joke, or even taking offense, you interpreted it as further evidence of my debility.

By the age of 18 I had serious differences with the prevailing philosophy and ethics where I lived. I made no bones about it. With a little more maturity I concluded it was rude going around telling people they were full of crap. Besides, it did nothing to convince them. It just pissed them off. You really need to work on the impression of arrogance you often give. It seriously annoys people. It offends people who might otherwise be inclined to support some of your ideas.

I've been lazing about the house for the last few days. I am feeling fit again. It's time to get in the pool and swim a few laps, then I have some errands to run. I will say, as Bill O''Reilly does so charmingly on Fox News, after he has interrupted, contradicted, bullied and abused his guests, "You may have the last word."

(I hope you don't feel abused....)

RNJ

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date May 31 2011 23:35:08

|

|

BarkellWH

Posts: 3458

Joined: Jul. 12 2009

From: Washington, DC

|

RE: Taxes, Corruption (in reply to Richard Jernigan) RE: Taxes, Corruption (in reply to Richard Jernigan)

|

|

|

quote:

Not long after, through ineptitude and capitalist fear, we drove the socialist revolution of Cuba into the arms of the Soviets, though Castro had made overtures of friendship to the US. This led to lasting enmity, and during the Cuban Missile Crisis, it nearly led to thermonuclear holocaust.

Subsequently we deposed the legitimately elected Salvador Allende in Chile, and installed the fascist dictator Pinochet, with far more fatal consequences. We supported Los Gorilas in Argentina, who "disappeared" hundreds, likely thousands. Misinterpreting our support, they started the Falklands War.

With all due respect, Richard, you are wrong in your analysis and conclusion regarding the United States' involvement with Castro in the early years, in your assumption that we "installed the fascist dictator Pinochet," and in your reasoning regarding Argentina's initiation of the Falklands War.

A. The United States did not drive "the socialist revolution of Cuba into the arms of the Soviets." Fidel Castro and Che Guevara were not "fence-sitters" after taking over Cuba, waiting to see which direction they would take, depending on the U.S. response. Long before (if you read their writings), they had opted for, if not outright communism, at least a strict form of Marxism, which very quickly turned into communism. In fact, the U.S. in 1960 offered to pay a much higher price for Cuban sugar, which Castro rejected as a form of "colonial dependency." The Cuban ideological direction had already been set by Castro, regardless of the U.S. response.

B. One of the Left's enduring myths is that the United States was behind the planning and execution of General Augusto Pinochet's 1973 coup in Chile that overthrew the government of Salvador Allende. As was brought out in Senator Frank Church's 1975 Senate hearings on the CIA's intelligence activities, the CIA did provide $8 million over a three-year period to various opposition groups in Chile to keep them going, including labor unions, the anti-Allende newspaper El Mercurio (which Allende was attempting to shut down by having the nationalized banks withhold credit for newsprint), and others. Nevertheless, the U.S. provided neither funding nor assistance in the planning and execution of the coup itself. Although Embassy officials had evidence that something was afoot, they were not privy to the timing and actual plan itself.

Anyone who has served in Chile and studied the 1973 coup would find it laughable to hear someone insist that the Chilean military would need assistance from the U.S. The Chilean military was based on the Prussian model, was (and is) a very professional military, and was perfectly capable of planning and executing the coup on its own.

That the United States was glad to see Allende overthrown is undeniable. It does not follow, however, that the United States engineered the action that led to his overthrow. The Left's narrative of General Pinochet's coup in Chile is one more example of the mental and ideological prison in which it dwells. That does not mean that it should be accepted by rational minds capable of rational inquiry regarding the events as they unfolded.

C. The United States gave Argentina no reason to suppose that we would support them in their attempt to invade and wrest the Falkland Islands from the United Kingdom. Argentina did attempt to gain our support, but nobody gave them reason to believe that it would be forthcoming. The only U.S. official who even vaguely appeared to be neutral was our UN Ambassador, but even she did not encourage Argentina. The United States was squarely on the side of the United Kingdom from the beginning. I might add that most of South America was glad to see Argentina defeated. They supported Argentina publicly, but they were glad to see the Argentines get their comeuppance. Chile, for example, had a secret agreement to allow British Vulcan bombers to refuel in Chile.

Cheers,

Bill

_____________________________

And the end of the fight is a tombstone white,

With the name of the late deceased,

And the epitaph drear, "A fool lies here,

Who tried to hustle the East."

--Rudyard Kipling

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Jun. 1 2011 1:51:18

|

|

Richard Jernigan

Posts: 3430

Joined: Jan. 20 2004

From: Austin, Texas USA

|

RE: Taxes, Corruption (in reply to BarkellWH) RE: Taxes, Corruption (in reply to BarkellWH)

|

|

|

To clarify:

I never said Castro et al ever entertained any economic model other than strict Marxism, or even communism. I said they had made overtures of friendship to the U.S. Whether this was actually a friendly gesture, or whether it reflected a hope for neutrality by the Colossus of the North, we ended in rejecting the socialist Cuban revolution, due to its Marxist ideology, and due to their increasing rapprochement with the Soviets.

No doubt you have more detailed knowledge of events in Chile, having served there. I believe the Chilean military acted with the full support and acknowledgement of the U.S.

I was acquainted with John Tower, the Vice Chairman of the Church Committee. Our company's Political Action Committee contributed enough to his campaign fund that every several weeks he would have lunch in our executive lunch room and give us a chance to pull on his arm about defense programs of special interest to us. My impression of U.S. actions in Chile is based chiefly on a few general conversations on the subject during those weekend lunches. Here is a section of the Church Committee Report, hosted on the State Department's web site.

quote:

http://foia.state.gov/reports/churchreport.asp

"in 1970, the CIA engaged in another special effort, this time at the express request of President Nixon and under the injunction not to inform the Departments of State or Defense or the Ambassador of the project. Nor was the 40 Committee (2) ever informed. The CIA attempted, directly, to foment a military coup in Chile. It passed three weapons to a group of Chilean officers who plotted a coup, beginning with the kidnaping of Chilean Army Commander-in-Chief Rene Schneider. However, those guns were returned. The group which staged the abortive kidnap of Schneider, which resulted in his death, apparently was not the same as the group which received CIA weapons.(3)

When the coup attempt failed and Allende was inaugurated President, the CIA was authorized by the 40 Committee to fund groups in opposition to Allende in Chile. The effort was massive. Eight million dollars was spent in the three years between the 1970 election and the military coup in September 1973. Money was furnished to media organizations, to opposition political parties and, in limited amounts, to private sector organizations.

Numerous allegations have been made about U.S. covert activities in Chile during 1970-73. Several of these are false; others are half true. In most instances, the response to the allegations mus be qualified:

Was the United States DIRECTLY involved, covertly, in the 1973 coup in Chile? The Committee has found no evidence that it was. However, the United States sought in 1970 to foment a military coup in Chile; after 1970 it adopted a policy both overt and covert, of opposition to Allende; and it remained in intelligence contact with the Chilean military, including officers who were participating in coup plotting" .

If the U.S, was not directly involved in the coup, it wold seem it was not for lack of trying.

I am willing to substitute for Chile the actions of the U.S. in Mexico, where we openly and actively supported the murderous drunkard Victoriano Huerta for President, helping to ignite the Revolution which subsequently killed a significant part of the entire population.

I didn't say we supported Los Gorilas' adventure in the Falklands. I said they misinterpreted our support. Phrased more fully, they misinterpreted our support for their actions in Argentina itself as a tacit signal that they could go ahead with their eventual fiasco. I am not alone in this opinion. I risk citing a Wikipedia article because it contains citations for its sources:

quote:

http://en.wikipedia.org/wiki/Events_leading_to_the_Falklands_War#cite_note-2

President Galtieri, as head of the military government, aimed to counter public concern over economic and human rights issues by means of a speedy victory over the Falklands which would appeal to popular nationalistic sentiment. Argentine intelligence officers had been working with the Central Intelligence Agency (CIA) to help fund the Contras in Nicaragua, and the Argentine government believed it might be rewarded for this activity by non-interference on the part of the United States if it invaded the Falklands. The Argentine leadership had noticed that during the Suez crisis 1956 the USA had objected to the British use of force, that in 1981 the UK reached agreement with the former colony Rhodesia and that 1961 Indian Annexation of Goa was initially condemned by the international community and then accepted as a fait accompli.[3]

Argentina exerted pressure at the United Nations by raising subtle hints of a possible invasion, but the British either missed or ignored this threat and did not react. The Argentines assumed that the British would not use force if the islands were invaded.[4][5]

According to British sources, the Argentines interpreted the failure of the British to react as a lack of interest in the Falklands due to the planned withdrawal (as part of a general reduction in size of the Royal Navy in 1981) of the last of the Antarctic Supply vessels, HMS Endurance, and by the British Nationality Act of 1981, which replaced the full British citizenship of Falkland Islanders with a more limited version.

3. ^ David R. Mares, "Violent Peace", 2001, Columbia University Press, ISBN 0-231-11186-X, page 156

4. ^ "Que tenía que ver con despertar el orgullo nacional y con otra cosa. La junta —Galtieri me lo dijo— nunca creyó que los británicos darían pelea. Él creía que Occidente se había corrompido. Que los británicos no tenían Dios, que Estados Unidos se había corrompido… Nunca lo pude convencer de que ellos no sólo iban a pelear, que además iban a ganar." ("This was neither about national pride nor anything else.The junta —Galtieri told me— never believed the British would respond. He thought the West World had gone corrupt. That British people did not have God, that the US had gone corrupted… I could never convince him that the British would not only fight back but also win [the war].") La Nación / Islas Malvinas Online. "Haig: "Malvinas fue mi Waterloo"". Archived from the original on September 8, 2006. Retrieved September 21, 2006. (Spanish)

5. ^ [1] La Operación Rosario fue concebida como una acción militar sorpresiva destinada a provocar una repercusión política internacional tal que obligara a Gran Bretaña a encarar seriamente las negociaciones sobre la soberanía de las islas de acuerdo con las resoluciones de las Naciones Unidas. Por esa razón, se planeó la ocupación, la instalación de un gobierno argentino y la retirada inmediata de las fuerzas intervinientes, excepto los efectivos indispensables que requiriera la seguridad. No se previó una reacción de la magnitud que tuvo la británica, que llevó a un conflicto que no se deseaba y para el cual no se estaba preparado.

Note that the English translation of 4. is wrong. The first sentence of the English says the exact opposite of the Spanish.