Welcome to one of the most active flamenco sites on the Internet. Guests can read most posts but if you want to participate click here to register.

This site is dedicated to the memory of Paco de Lucía, Ron Mitchell, Guy Williams, Linda Elvira, Philip John Lee, Craig Eros, Ben Woods, David Serva and Tom Blackshear who went ahead of us.

We receive 12,200 visitors a month from 200 countries and 1.7 million page impressions a year. To advertise on this site please contact us.

|

|

|

RE: José Ramirez III for sale jewel...

|

You are logged in as Guest

|

|

Users viewing this topic: none

|

|

Login  | |

|

Richard Jernigan

Posts: 3430

Joined: Jan. 20 2004

From: Austin, Texas USA

|

RE: José Ramirez III for sale jewel... (in reply to Ramon Amira) RE: José Ramirez III for sale jewel... (in reply to Ramon Amira)

|

|

|

Please let me know when you are selling Ramirez guitar for a penny. I may be able to make some money.

quote:

ORIGINAL: Prominent Critic

Well, I’ve made the distinction clear as day, but you insist on conflating the two different meanings of “regulate,” so I just can’t spend any more time on this. If a market is free then it will self adjust, or "self-regulate" prices to their lowest point. The point is not even arguable, as it is illustrated all around us in countless different markets where competition drives down prices. Not one single thing you have said in any way refutes that.

Mortgage backed securities and credit default swaps traded at escalating prices until those watching the housing market noticed that house prices had peaked in mid-2007. By 2008 large quantities of these securities became totally worthless. They could not be traded at all. Now some of these are salvageable at something like a tenth to a quarter of their 2007 prices, some are back near their pre-crash par. The regulatory laws did not change during the escalation and precipitous drop in prices. The legislative consensus was that the market in these instruments was too free so a more restrictive set of laws were passed. Little has changed in the actual active enforcement of trading in these instruments, due to the prolonged process of developing regulations to implement the new laws, under a storm of lobbying by the banks.

This is a clear case of the chaotic behavior of a "free market" which did not behave in the "rational" fashion modeled by economists--a classic financial bubble and panic. The credit markets collapsed when people realized they could not evaluate the balance sheets of their trading partners who were heavily invested in these toxic assets. The entire world economy went to Hell in a hand basket. Millions of people lost their jobs and their homes.

All this happened within the last five and a half years. i should think it would have affected your guitar sales. It certainly affected the price I was able to negotiate when I paid cash for my house in January, 2009, while many doubted that the credit markets would recover any time soon.

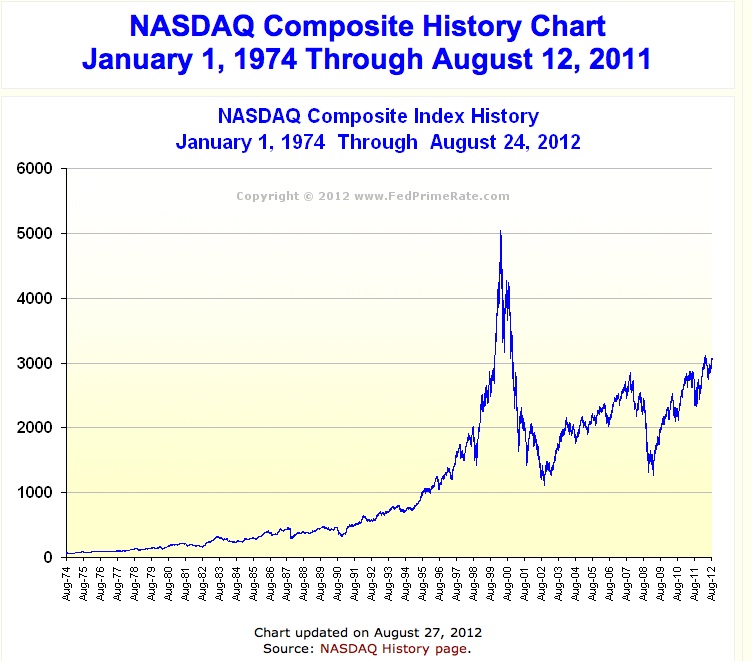

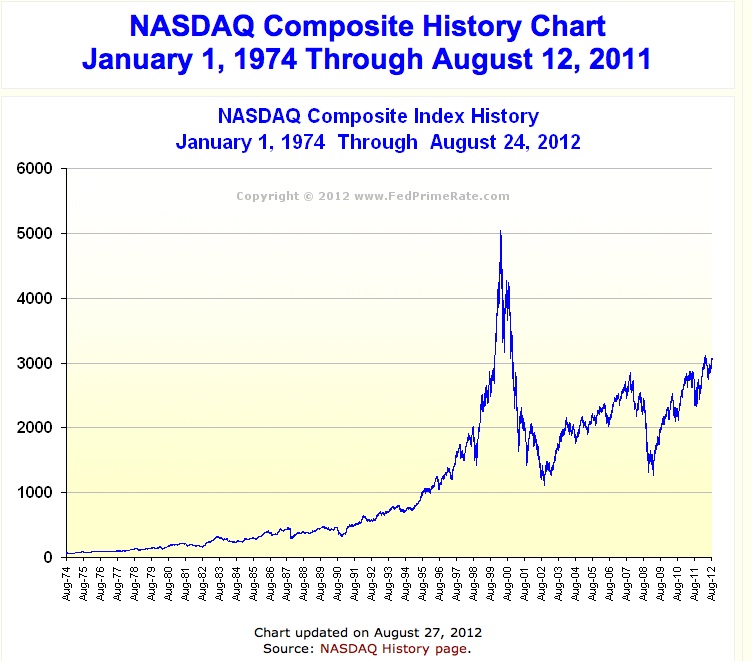

Another recent example of irrational market behavior was the NASDAQ stock exchange bubble of the late 1990s. Yes, at the peak, the cheapest you could buy the NASDAQ Composite Index in the free market was $5000. But you would have been a fool to do so, since only a few months later the same stocks had crashed, and two years later they were worth only $1200.

Then there was the Asian currency crisis of the mid-1990s. About a sixth of the total world economy simply evaporated in a period of a few months, due to the collapse of speculative currency markets. Booming stock markets in Korea, Taiwan, Thailand, Singapore and Indonesia all went down in flames.

Malaysia wasn't hit quite as hard due to their apostasy from the doctrine of free trade. They instituted currency import, export and exchange controls. There was a good deal of grousing about this in the editorial pages of the Wall Street Journal, the Economist and The Financial Times. Malaysia's reaction was, "You've got to be kidding! Look at what happened to countries who allowed their economies to be destroyed by people pressing keys on currency trading computer keyboards."

As it happened, I made money in all these markets. It wasn't because I thought they were operating rationally. In retrospect I could have made even more. Or I could have lost my ass, as a number of my friends did. In each case I invested because the conventional wisdom said it was the thing to do, but I got scared and got out before the crash. It was as much good luck as anything else. But I never felt like I was participating in a rationally self-regulating market. Most of my friends who lost big thought they were. Many of them were at least as smart, and better informed about the financial world than I was.

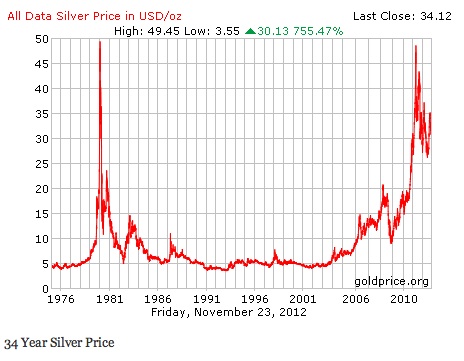

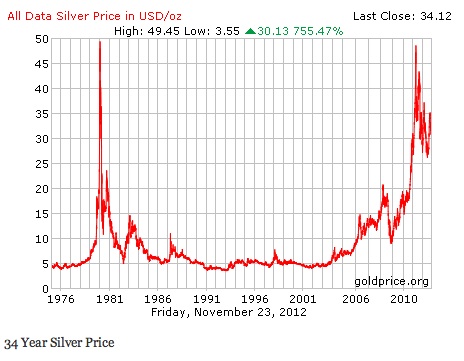

"All this financial stuff is just smoke and mirrors," you may say. "Talk about something physical that has an actual use." Okay. How about silver? It's a commodity with wide industrial use. Its price should be driven by supply and demand in the free market. Yeah, right:

Even during the relatively quiet period from 1996 to 2001, there was a sudden 50% upward blip in the price of silver. Supply and demand? Looks like speculation to me. Not on the grand scale of 1980 or 2011, but still...

My wife profited from the 1980 attempt of the Hunt brothers and their Arab partners to corner the silver market. She inherited $10,000 face value in U.S. silver coins that her mother had accumulated over the years. A dollar in face value was about an ounce of silver. She got out at $45 on the way down. In a sense, those coins were valuable. My wife traded them for dollars which declined only slowly in purchasing power. She invested the dollars and made money in terms of purchasing power. But would anyone seriously claim that the underlying commodity, an ounce of silver, was ten times as valuable in 1980 as it was in 1978 or 1982?

Oil is a bit more complicated. A cartel controls much of the world supply. But people who know the business say speculation is a significant driver in the price of oil.

When my Dad retired from the Air Force and worked as a stockbroker for several years, he used to say, "What goes up too fast, must come down the same way." One of his favorite books was the classic "Popular Delusions and the Extraordinary Madness of Crowds."

As I remember, the book began with the Dutch tulip mania of the early 17th century where the balance of supply, demand and competition did indeed drive prices--first to staggering heights, and then to a crash. Again as I remember, the book went on to the South Sea Bubble in early 18th century England, and progressed through the main succeeding bubbles and crashes up until the Great Depression of the 1930s. Dad thought it ought to be required reading for all investors.

You may have traded in a relatively orderly market for guitars. That doesn't mean that all "free markets" behave the same way as yours.

RNJ

Images are resized automatically to a maximum width of 800px

Attachment (2) Attachment (2)

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 25 2012 9:09:56

|

|

BarkellWH

Posts: 3458

Joined: Jul. 12 2009

From: Washington, DC

|

RE: José Ramirez III for sale jewel... (in reply to XXX) RE: José Ramirez III for sale jewel... (in reply to XXX)

|

|

|

quote:

THings dont have a use by nature. It takes human mind and labor to create things (either from nature itself or artificially) of use. Useful hence valuable. Because this process takes time it makes sense economically to associate time and use in the term use value and average socially neccessary labor. The relation here would be between time and use. The reason why you cannot imagine such a thing is because for you value needs to be connected to property and trade. BUt these categories, ie property, are in fact the ones that do not exist in the products. It is something that humans impose on the things. Use value is nowhere but within a given product.

About food, that was one of millions of examples, but the most obvious one, to show that if a system is able and has the productivity to fly to the moon, produce luxury goods and even produce food in huge amounts, yet still not being able to provide a "supply" of this most basic (!) need for more or less everyone, then its not just a nuisance. If in 150 years of capitalism the most basic needs of humans cant be satisfied, although all neccessary means are available, then i conclude, that satisfying those needs was never the purpose. And indeed, it was just accumulation that was the purpose, and the use value of products was just a vehicle to get the real interesting thing, ie exchange value. Guys like Adam Smith wanted to show that there is accumulation, but somehow the supply still works. Because they wanted to justify the system. But its more interesting to look at how the supply appears in capitalism: it is only the vehicle, a means to get exchange value.

Yes, when human beings create and produce things that are deemed useful, such items have a value. But for the nth time, the amount of "value" is not inherent in the object itself, and it is not determined by the amount of "socially necessary labor" (to quote Marx) that goes into its production. The ultimate value of the item produced will be determined by demand, as reflected by the market acting as a clearing house for supply and demand.

Capitalism is not perfect. No system is. Nevertheless, the last 150 years (your time-frame) have shown capitalism to be a far greater engine for providing the most basic needs, and much more, for humans than any other system. China is a good example. Under Mao's version of communism, the totalitarian state produced nothing but famine. Agriculture was poor. Manufacturing was abysmal. When the state confiscated a certain percentage of production, there was naturally no incentive for anyone to produce. Since the 1978 reforms introduced by Deng Xiaopeng, China has introduced free market incentives that have resulted in huge gains, both in manufacturing and in agriculture. Of course, China's market is not completely free. No market in the real world operates without some necessary checks. But the relatively free market, coupled with incentives to produce and engage in entrpreneurship, have lifted literally tens of millions of Chinese out of poverty. Is there inequality in China? Of course there is. But inequality, with the incentives to produce and make a better life for oneself, is far preferable to the old system under Mao where everyone was equally poor and equally oppressed by the system.

Cheers,

Bill

_____________________________

And the end of the fight is a tombstone white,

With the name of the late deceased,

And the epitaph drear, "A fool lies here,

Who tried to hustle the East."

--Rudyard Kipling

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 25 2012 10:50:59

|

|

Ruphus

Posts: 3782

Joined: Nov. 18 2010

|

RE: José Ramirez III for sale jewel... (in reply to Ruphus) RE: José Ramirez III for sale jewel... (in reply to Ruphus)

|

|

|

Richard,

Absolutely agreed on your intelligent objections on theoretical limits.

Yet, sober reflection aiming at societal sense, however hard balancing be, will in the first place yield much more reasonable and related than a method does that priors profit and enrichment of a minority.

There will be benchmarks to orient on and ways to approach usefulness. All inevitably leading to way more fitting to societies than an accumulating economy to minorities.

Conditions that are blured to such extend that common sense can´t even see anymore glaring impropriety ( with the social gap, or with less than an hour of efforts requiring sneakers that cost a worker´s monthly wages, a war plane that costs over a billion USD, or with combed energy tarifs that have come to now ruining Europe´s lower middle class ) will then be a nobrainer at least.

With aiming at reason there will be ground to evaluate on.

At whatever state of development, aiming at commensurate proprotions will be so constructive in contrast to the current arbitrary state of no reasonable concern and its aisle of destruction.

"You insist on the absolute truth of the injustice of the "alienation of labor". That's where you want to start from scratch. Others insist that this is hogwash."

If that be "hogwash" then someone owning their flesh could be ligitimate on the other hand. I am sure you wouldn´t want to bet that suddenly the same minds would object and find clear reason as to why their bodies belonged to themselves.

Just because an opinion would be allowed to consider self-explanatory circumstance hogwash, it doesn´t imply in the same time that there was substance behind superficial opinion.

Reflecting the complexity of matters is alright and adequate, but different from giving in to ****. - Otherwise we might just as well return to the intellectual background of slave holders and pay attention to that.

Similar with the realism of Ramon / todays common sense.

For such world view marketing value becomes "reality" and production efforts "theory". If that be no classical example for upside down perception then what is.

Exact same kind of stringence with the claims about a "free market". Where on earth has there existed such? And how on earth could an economizing method that votes profits above all things ever enable a market that be free? How blind must an intellect be to assume that solid pecuniary predominance could be giving way to a free market?

How numb must a mind be to have not observed all the cartells, monopolies, price gauging and instigation of official instances to prevent exactly a free market? ... Expecting to work what we name "Making gardener of the goat" in German.

Let alone the observation skills needed to realize all the missed opportunities, the sabotage and destroyment that comes with the blindly praised competition. "Regulation" my rear.

One should be knowing better even yet after exclusive use of conservative media.

What I meant with working out step by step was scientists relatively circling in proportions.

However a common sense as displayed above confirms that a step by step information for the people would be needed beforehand. Where there very basics be not clear yet like labour as workers´propriety, and how it is being inherent to major marketers to manipulate markets to their interest, there basic clearing is obviously required first.

This is why I am pessimistic.

Even just basic understanding is so lost that peoples´coming to reason will be taking so much longer than a ecological break down allows.

There are small signs of awakening everywhere, and the more capitalist degeneration and environmental havoc the more reports there come up about groups and celebrities taking humane measures.

However, with the gross lackings of common sense I see no chance for preserving what´s left intact of the planet and of humane being.

Capitalist stupity and shortsightedness has driven men to insanity and there´s no timely buffer stop in sight.

-

Ramon, Bill,

Do you know what illegal lumbers in the Taiga get for a whole trailer full of huge trunks ( ~ upwards from 80 cm diameter )? 3000 bucks.

Do you know what this wood ends up at for your average consumer?

The guy who owns the trailer, or the one who employs the cutting crew, won´t be getting much more out of it than maybe your average NY taxi driver. But the guy who shoves it through the mill and ships it, and more even the ones receiving it abroad earn themselves golden water taps.

That is the heart of capitalism. It causes the most blatant, lasting and global damages to serve minorities of unscrupulous and their temporary interests.

What does it take yet for you to understand what you are defending there? Injections of brain water to learn like in those experiments with rats, where the one group received cognitive achievements of the other physically?

Can you not comprehend by your own means that we are about to distroy this planets advanced evolution and biodiversity for a sheer idiotic state of blindness and irresponsibility conditioned by a votiv of capital?

Do the media you consume not show desasters increasing from month to month?

No?

So, why not switch channel for a moment.

Escaping the ugly will not dematerialize it.

Ruphus

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 25 2012 11:39:50

|

|

BarkellWH

Posts: 3458

Joined: Jul. 12 2009

From: Washington, DC

|

RE: José Ramirez III for sale jewel... (in reply to Ruphus) RE: José Ramirez III for sale jewel... (in reply to Ruphus)

|

|

|

quote:

What does it take yet for you to understand what you are defending there? Injections of brain water to learn like in those experiments with rats, where the one group received cognitive achievements of the other physically?

For you to use the example of Russian thugs dealing in illegal lumber from the Taiga as an example of capitalism and the free market suggests that you are the one who needs injections of brain water to learn, Ruphus. Y0u really need to go back and take a basic course in comparative economics, if you have the intellectual honesty to actually learn something from it, and if you are willing to keep an open mind and dispense with your preconceived ideological position.

And don't flatter yourself into thinking you possess superior knowledge by suggesting that there is no such thing as a "free market." We all understand that when we speak of a "free market" we are speaking of the market operating as a clearing house for supply and demand to determine price, and that it operates within a set of regulations and checks. By "free," what is meant is that the market is open for producers to freely participate and compete, and thus engage in determining the quantity and quality of supply that together with demand determines the equilibrium price of a product at any given time.

Cheers,

Bill

_____________________________

And the end of the fight is a tombstone white,

With the name of the late deceased,

And the epitaph drear, "A fool lies here,

Who tried to hustle the East."

--Rudyard Kipling

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 25 2012 17:37:38

|

|

BarkellWH

Posts: 3458

Joined: Jul. 12 2009

From: Washington, DC

|

RE: José Ramirez III for sale jewel... (in reply to XXX) RE: José Ramirez III for sale jewel... (in reply to XXX)

|

|

|

quote:

About "socially necessary labor" determining value.. it is exactly the thing that does NOT determine value in capitalism, and that was his criticism that it doesnt do that.

And, as I stated previously, that is precisely where Marx's criticism was wrong. "Socially necessary labor" cannot determine value in a capitalist, or even in a socialist, economy. Demand (coupled with quantity and quality of supply) determines value in the form of the equilibrium price reached via the market. Rationally, that can only be determined by the market acting as a clearing house for supply and demand. Any other method--five-year plans, command decisions from the top, determination of the hours and wage that went into production--results in irrational decisions based on long-discredited Marxist theory.

Cheers,

Bill

_____________________________

And the end of the fight is a tombstone white,

With the name of the late deceased,

And the epitaph drear, "A fool lies here,

Who tried to hustle the East."

--Rudyard Kipling

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 25 2012 17:39:34

|

|

Richard Jernigan

Posts: 3430

Joined: Jan. 20 2004

From: Austin, Texas USA

|

RE: José Ramirez III for sale jewel... (in reply to Ruphus) RE: José Ramirez III for sale jewel... (in reply to Ruphus)

|

|

|

It seems to me that the moral justification of capitalism often goes like this:

Capitalism has produced the largest rise in standard of living for the largest number of people of any economic system in history. In return for this great good it is worthwhile to accept the parasitism of some (not all) of the super wealthy, those who game the system producing no social benefit, and to accept a degree of economic (and implicitly social) inequality.

So far, so good. But now the super wealthy control an inordinate amount of wealth in capitalist societies, much of it tied up in non-productive "financial engineering" which benefits only those who have enough money to invest.

Furthermore, there are homeless people, the chronically unemployed, undernourished and uneducated. Some of these people are "responsible" for their own situation, by far the majority are the victims of circumstance.

In the Marshall Islands, most people have neither a pot to piss in nor a window to throw it out of. Yet there are no homeless people, and everyone gets enough to eat--no matter how lazy, stupid, crazy, drunk, dirty or offensive they may be.

During the first five or ten years I lived in the Marshall Islands, each year when I returned to the USA to visit family, I would stop off in San Francisco to see my former girlfriend. The throngs of homeless people on foggy and cold lower Market Street were painful to see, after the tolerance and mutual caring of the islands.

Then there's the problem of environmental destruction. Solshenitzyn notoriously said that, despite its enormous cruelty and injustice, the Soviet system was morally superior to capitalism because its inefficiency slowed its damage to the environment. Little did he know of the environmental disasters perpetrated by a bureaucracy that was politically unaccountable.

Time is running out.

On my first trip to Southeast Asia I fell into conversation with a scientifically educated Buddhist monk at the Royal Palace in Bangkok. We had an interesting talk about the Buddhist attitude toward science. His view of science was positive, but in my opinion a little unrealistic in his underestimate of how necessary competition and self-interest are for the advancement of science. But his remark that struck me the most was, "The chief characteristic of the modern age is the stunning rapidity with which the rich can eat up the poor."

I still maintain that no "scientific" theory of economy or politics has been advanced that will even work consistently, much less cure the ills of mankind.

The Cuban elite has maintained the trust and respect of the masses longer than in any other socialist economy I know of, but this is beginning to fray. The bureaucracy is coming to be viewed as a privileged class, with their control of power and their access to luxury goods through the hard currency stores.

http://en.wikipedia.org/wiki/Cuban_peso

As soon as they were legalized, small shops sprang up in doorways and living rooms throughout the country, profiting from the "alienated labor" of agricultural and manufacturing workers, as the Marxian theorists would have it. The scale of free enterprise is sharply limited, and the published policy is that it will never be allowed to exploit people. But now the formerly ultra-Marxist regime is wrestling with the question of what precisely constitutes "exploitation." Nobody seems to know the answer.

Since we know of no cure-all, what we need to do is to inform ourselves and work step by step to correct the evils of the world we live in now.

RNJ

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 25 2012 20:40:25

|

|

Richard Jernigan

Posts: 3430

Joined: Jan. 20 2004

From: Austin, Texas USA

|

RE: José Ramirez III for sale jewel... (in reply to BarkellWH) RE: José Ramirez III for sale jewel... (in reply to BarkellWH)

|

|

|

quote:

ORIGINAL: BarkellWH

The ultimate value of the item produced will be determined by demand, as reflected by the market acting as a clearing house for supply and demand.

Cheers,

Bill

I would say that the price of the item is determined by the market not its value. See the example of silver above. And among the major forces acting upon the market price besides supply and demand is speculation in many important cases, not true demand.

I'm not saying I know how to determine value, as against price. But in my opinion one of the weaknesses of capitalist theory is the identification of price with value. The price of an article can be driven all over the place by market forces, while the actual supply and demand remain the same. Of course my position explicitly contradicts classic capitalist theory, which identifies price with value.

Could we define "value" as the price the market would assign absent market forces other than actual supply and demand? This might seem attractive to a theorist, or it might even be the real position of a classical capitalist, relying upon the idea of some hypothetical free market, but it drifts so far from reality as to be just about devoid of practical value--err, I should say usefulness.

Could the difficulty lie deeper? Could the trouble be the attempt to measure everything in terms of money? From its invention on forward, some people have been very clever in the manipulation of money to get rich with a minimum of actual work.

In a financial theory of relativity, the yardstick of value would expand for a rich person, shrink for a poor one. A nice car is worth more to a poor person, measured by many lengths of his short stick, than it is worth to a rich man, measured by a few lengths of his long stick of value, though the number of dollars is the same for both.

Maybe that's why the super wealthy always seem to need more stuff. The more stuff they get, the less each item is worth, so they have to keep on piling up the loot to keep from falling behind.

And too many of them just stash the money in the "financial engineering" markets, living handsomely off the proceeds, instead of employing it in useful work. G. W. Bush and his allies reduced taxes on the rich. Their share of assets and income went up. So did unemployment and the deficit.

RNJ

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 25 2012 22:01:28

|

|

BarkellWH

Posts: 3458

Joined: Jul. 12 2009

From: Washington, DC

|

RE: José Ramirez III for sale jewel... (in reply to Richard Jernigan) RE: José Ramirez III for sale jewel... (in reply to Richard Jernigan)

|

|

|

quote:

I would say that the price of the item is determined by the market not its value.

I would say that the price of an item, as determined by the market acting as a clearing house for supply and demand (and absent extraneous distorting factors), would also be the "objective value" of the item. Objectively, the price would be its value, as reflected in the equilibrium price determined by supply and demand at any given moment.

To use your example of how the "value" of an item might be defined differently by an extremely wealthy person, as opposed to, say, a lower middle class person, that is a wholly subjective determination and has nothing to do with the objective value assigned via the market. A nice car may be of little "value" to a wealthy person, because he can afford an even nicer one. But it may be of great "value" to a lower middle class person, because it may be the nicest car he will ever own. These are subjective judgments regarding "value," as filtered through the lens of each person's relative position in society. The objective value of the car under consideration, however, will be determined by the market and will be reflected in its price at any given time. That price will be the same for the wealthy person and the lower middle class person, regardless of the differing, subjective, personal "value" each places on it.

Cheers,

Bill

_____________________________

And the end of the fight is a tombstone white,

With the name of the late deceased,

And the epitaph drear, "A fool lies here,

Who tried to hustle the East."

--Rudyard Kipling

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 26 2012 1:03:47

|

|

Ruphus

Posts: 3782

Joined: Nov. 18 2010

|

RE: José Ramirez III for sale jewel... (in reply to Richard Jernigan) RE: José Ramirez III for sale jewel... (in reply to Richard Jernigan)

|

|

|

Richard,

I don´t think that there is a problem with money as intermediate means of trade.

Problems come up rather with disproportion of compensating and pricing, which could also occure without currency. Say, for illustration, if a person offering a pound of nails would in return request a whole set of chairs with dining room table for it. Or if an employer would pay off a carpenter with 10 kg of meat at the end of the month. ( Which is ironically what the worker could buy with his average salary over here, currently. - Under exploding inflation.)

While direct trading ( without currency) would likely help keeping perspective on proportions / make it harder for racketeers, the problem is not with the form of money.

-

No doubt that subjective value does motivate human behavior. ( Can you imagine how precious those tulip bulbs might have appeared to some folks back then? - Or look at those boutique label jeans for a grand or more ... Contemporary Champagne bottles for 12 000 bucks etc. pp.)

But compensation for unappeased drives is a way more consistant and strong motor of behaviour. - And much more effective background for restless accumulation than enhanced collecting caused for decreased appreciation of goods.

Exploitation and its induced shortage of parental spare time and emotional well-being results into under cared youth with considerable issues of inferiourity complex.

Those produce incurable accumulative motivation off limits.

The restless accumulation thus is not so much reasoned in lesser appreciation of material standard ( which should rather be running out above some tenth or hundreds of million $), but the pathological disability to accept that others will still be owning more. This is not to say that drive compensation could ever be filled - when a person in question "won" as richest / mightiest in the world -, but that it is what the diseased vainly expects.

Bill,

I am sorry for the brain water mentioning. I went overboard.

It itches me incredibly how people to this day come to defend capitalism, in the same time ( allegedly) aiming for reason.

That is like saying that meat eating wouldn´t harm any animal.

Such gross and evident contradiction.

And yet when pointed to inconsistent and disconnected thinking; nothing can impress you enough to halt for a moment and follow a string of consciousness.

Neither when you conclude, nor when you could try to note conclusive circumstances.

For the first your example of Chinas bloom through Capitalism.

That is just how out of all retarded religious claim to be highly innovative and how their doctrine had the Middle East scientifically flourishing through their upcoming. Completely isolatedly and selectively interpreting and skipping the actually causal facts of the early Middle Age.

In the first place there is no current comparison to Chinas past when the country was economizing vastly on its own. Secondly, with Chinas economical uprise connected to the rest of the world, for actual assessment there is to be considered as well the disproportionate getting behind of the latter.

Just have a look at your country and all its fallow manufactory with the enhanced China trade.

And you are not yet at the final outcome of the temporary bonanza of leading managements who defunct their companie´s plants, and the primary recession effect of that for your national economy.

For the second your insensibility for unwanted conditions.

Like with the illegal Taiga lumbering and its capitalist background that you can´t see.

The free market as is practically promotes two things before all.

One is alienation of labour value ( latently), the second is legitimized usury ( patently).

You see pricing of wood, and how a couple of small wood sheets cost hundreds of dollars? It is that rampant that induces the destroyment of the Taiga and all of remained primare forests. At reasonable pricing this and uncounted of other evironmental destruction would not be coming up in the first place.

You see? The way you neglect yet the most obvious, shows how you do not want to think about questionable conditions.

That way yet the most basic of points, hence no socio-economical regard can be treated.

Not the difference between isolated and wholy viewing, not the difference between price and value, and in the first place not the utterly obvious circumstance that a votive of capital has to inherently be the irresponsible and unethical socio-economical method that it is.

It must be so hard to understand that proring profits cannot ever be a method of societal, humane and reasonable response.

If you sincerely wish the latter you will have to inevitably accept the need of a societal, humane and reasonable way of economizing. It´s the logic of the matter.

Unless you prefer tending of flying pigs.

Your friendly capitalism of slaughtering feasts without a blood shed.

-

What I find most characteristic for conservative orientation is the absence of deconstructive thinking.

Obviously such omission -whether consciously or unconsciously- is essential for an inhumane political diretion.

Ruphus

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 26 2012 10:17:19

|

|

BarkellWH

Posts: 3458

Joined: Jul. 12 2009

From: Washington, DC

|

RE: José Ramirez III for sale jewel... (in reply to Richard Jernigan) RE: José Ramirez III for sale jewel... (in reply to Richard Jernigan)

|

|

|

quote:

What is the value of something which has no price, such as carbon dioxide emitted into the atmosphere in the USA? This lacuna seems more important than the lack of a price for lobsters in the Marshall Islands. "Cap and trade" seems to be working to subject sulfur dioxide and nitrogen oxides to economic forces, yet we do not implement it for CO2.

The objective value, as defined, is an abstract and indeterminable quantity for such an important commodity as oil, since a market for oil without the significant distorting factors of monopoly and speculation does not exist.

If your example of CO2 represents those externalities that are a harmful by-product of production (of automobiles, steel, energy, etc.), and if you are stating that it does not figure into the calculation of the cost, and therefore value/price, I agree with you. But it does not discredit the idea that the value of a product is represented at any given time by its price as determined by the market mechanism acting as a clearing house for supply and demand. Harmful externalities as by-products of production will only enter the cost-value-price calculation, as determined by the market, when we as consumers are willing to demonstrate, via the market reflecting our demand, that we will accept only items produced in a manner that reduces those harmful externalities. Unless we are willing to pay the cost of reducing such externalities in the form of higher prices for the product, we have only ourselves to blame. Nevertheless, the market will still be the mechanism that reflects our demand, and therefore determines the price.

Regarding oil, it is much like agriculture. The oil cartel (OPEC) monopoly and government agricutural subsidies/price supports and tariffs are the exceptions that prove the rule about free markets determining the equilibrium price of a product or commodity at any given time. They do not operate in free markets and the resulting distortions are readily apparent. In my opinion, I would do away with all agricultural subsidies, price supports, and tariffs, and let market forces rule. We consumers would be much better off. Unfortunately, there is not much we can do about the oil cartel.

And now, I must sign off in order to practice a beautiful version of Malaguena which I am learning from my flamenco guitar maestro Paco de Malaga. Paco is a wonderful guitar guru, a mentor, and a great friend, and I have learned much from him, not only about flamenco guitar, but about the history, the development, and the great names in flamenco. Some time ago, Paco sold me a wonderful Gerundino that is my treasure. Paco got it directly from Gerundino himself (Paco knew Gerundino), and kept it in a personal collection of guitars. Paco wanted to reduce his personal collection and offered it to me at a reduced price from what it would fetch on the open market. He did it as my guru, mentor, and friend. It is an example of the market mechanism operating, albeit in a slightly distorted fashion in order to accommodate a friendship.

Cheers,

Bill

_____________________________

And the end of the fight is a tombstone white,

With the name of the late deceased,

And the epitaph drear, "A fool lies here,

Who tried to hustle the East."

--Rudyard Kipling

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 26 2012 11:47:26

|

|

XXX

Posts: 4400

Joined: Apr. 14 2005

|

RE: José Ramirez III for sale jewel... (in reply to BarkellWH) RE: José Ramirez III for sale jewel... (in reply to BarkellWH)

|

|

|

quote:

ORIGINAL: BarkellWH

Unless we are willing to pay the cost of reducing such externalities in the form of higher prices for the product, we have only ourselves to blame.

Nope. I was not involved in the design or working plan of any plant or other facility in the world that emits CO2, or any other harmful externality. I doubt that im responsible for others not acting according to standards which i would consider for my own actions as self-understood (not polluting the environment). And i most certainly do not need to cut any of my economic status, to make companies do something which is not only self-understood and reasonable, but also something they neglected to do because of their own purpose of maximizing profit. But its very telling and logically consistent within the capitalistic ideology, to look at who is in charge when companies "rationalize". Its not the company saving some money but cutting corners in security and environmental standards. Its the customer who doesnt give the company enough money to fullfill its role as angel. Now, it takes some effort to think of this pretty hostile relationship between producers and customers as "friendly" supply and demand. At the very least nobody demanded pollution.

Ruphus, money is not a means of trade. I explained this earlier in some posts too. IF it were, there wouldnt exist almost as many currencies as countries. Each currency is supposed to increase the economic power of its country, for example by spreading out and making those who hold dollar or euros to be dependant on that currency. If money is economic power in capitalism, currency is the strategy how to deal with different powers. Hence the "devalue" claims towards China, which wouldnt appear if it were a means, as trading is possible without a devaluation too.

_____________________________

Фламенко

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 27 2012 9:21:54

|

|

Ruphus

Posts: 3782

Joined: Nov. 18 2010

|

RE: José Ramirez III for sale jewel... (in reply to Richard Jernigan) RE: José Ramirez III for sale jewel... (in reply to Richard Jernigan)

|

|

|

You are right, Deniz.

Money is not only a means of trade, but also an economizing tool under given methods.

Very prominent examples being the one you mentioned with the western pressure on China to devalue, or the US´s economical support through other nations by bonding oil sales to the dollar.

I suppose to exclude thelike misuse there should be agreed on currency evaluation by fathoming individual values through a standardized shopping basket in the ways used for determining inflation ( - wherever currently that be honestly done, besides. In Germany for instance numbers on inflation are clearly being autocratically skewed and down played ).

All in all I suppose that it should be easy to determine actual value of currencies as national trading means, and to free them from misuse.

I do not see inherent issues with money as placeholder. It is the various ways of misuse that discredits this otherwise very practical means. Not at last with underhand principles of given banking ( which, together with brokering and insuring should be exclusively state-run anyway to prevent such as the given abyss ) that have been installed as fantastic people- and state fed skimming drainage.

BTW, have you noticed yesterdays news? How it was revealed about that person who made public the Hypo-Vereinsbank´s cash transfers to Switzerland, and instead of being thanked for by prosecutes, has been pushed into madhouse and explicitely declared lunatic by the minister?

One could had thought these methods to be of 3 decades ago, but only superficially.

And now that such fact has leaked out; what will the mafia behind it have to fear? Exactly nothing, as we know from history.

And here we are, still needing to point out the conception of profiteering methods and its immanent instigations, to who still prefer to firmly believe the top premisse of capitalizing could ever allow a foundation of sincereness and fair play in the same time. Just as well asking hippos to knit them pullovers. :OP

Ruphus

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 27 2012 10:41:52

|

|

Dave K

Posts: 155

Joined: Mar. 29 2006

|

RE: José Ramirez III for sale jewel... (in reply to XXX) RE: José Ramirez III for sale jewel... (in reply to XXX)

|

|

|

Well, I'd bet the US, along with Britain, Australia, Poland, and a few others have pulled you and Ruphus' sorry asses (Or your parents, grandparents etc) out of a jam more than once, so why don't you take your negativity and shove it where the sun dont shine?

And Richard, kissing their butts will not accomplish anything...

Bill, logic is wasted on these guys, why waste time?

Cheers,

Dave

_____________________________

Avise La Fin

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 28 2012 5:26:50

|

|

Ruphus

Posts: 3782

Joined: Nov. 18 2010

|

RE: José Ramirez III for sale jewel... (in reply to Richard Jernigan) RE: José Ramirez III for sale jewel... (in reply to Richard Jernigan)

|

|

|

Rob,

I´ve saidf it before: The method of escaping the ugly will not dematerialize it.

Some doctrins and billions of individuals believe that not looking at something would not allow it to come into existence.

It is why menkind is undauntedly sawing off the branch that it is sitting on.

Yet, the method of billions won´t confirm any practical usefulness to it.

No matter how you switch channels from documentaries to soap opera to flee the medusa, response to the blinkers is on the way to bite your rear. Yours, your beloved ones and their grand kids.

Quite likely will you be seeing the day when switching view won´t work anymore.

Deniz,

I don´t see the logic in your last post.

Was it not that the US and other´s manufacturing industry decided to boost their profits by using cheap labour in China? Is it not that they are now requesting China to artificially value up the Yuan for to leave some competitiveness to themselves?

No misuse if you request change of rules to own demand?

And the bounding to the dollar means that none-US economies who need import of mineral oil have to shed of their economizing power to the US by holding up the dollar. In fact without skimming supports like that the US economy would had collapsed already in the late seventies / early eighties when international papers described it as castle in the air.

Wait, I get your drift ...

But I don´t agree. Money can be a very helpful means. The way I sse it the issues come with the criminal spirit, not with the introduction of coins and bills.

David,

Your glorious "logic" appears disturbed by our sorry asses.

The aversion speaking in your post is not really meant to aim at us.

This is your unconsciousness that can´t overlook some superficial, egocentric layout and the uncultured being needed to keep denying the mess we mention.

Who ever is supposed to have bailed us out as you claim, it should hardly have been any of your mindset. For, what you care for is exclusively yourself. Not giving a rats ass about what could be proportionate or just, outside of your personal matter.

Such stance ought to make you rage against any instance that could even only indirectly be reminding you of your cheap being.

From there I know that I am on the right path when minds like yours get peeved.

Thanks for the heads up.

Should any of the coming global desasters get your butt, just make sure to not reincarnate as finned shark, skinned tiger, burned Indian worker or welfare recipient. Come down on as criminal in three-piece suit and you be set for come what may.

Ruphus

|

|

|

|

REPORT THIS POST AS INAPPROPRIATE |

Date Nov. 28 2012 12:06:16

|

|

New Messages New Messages |

No New Messages No New Messages |

Hot Topic w/ New Messages Hot Topic w/ New Messages |

Hot Topic w/o New Messages Hot Topic w/o New Messages |

Locked w/ New Messages Locked w/ New Messages |

Locked w/o New Messages Locked w/o New Messages |

|

Post New Thread

Post New Thread

Reply to Message

Reply to Message

Post New Poll

Post New Poll

Submit Vote

Submit Vote

Delete My Own Post

Delete My Own Post

Delete My Own Thread

Delete My Own Thread

Rate Posts

Rate Posts

|

|

|

Forum Software powered by ASP Playground Advanced Edition 2.0.5

Copyright © 2000 - 2003 ASPPlayground.NET |

0.140625 secs.

|

Printable Version

Printable Version

New Messages

New Messages No New Messages

No New Messages Hot Topic w/ New Messages

Hot Topic w/ New Messages Hot Topic w/o New Messages

Hot Topic w/o New Messages Locked w/ New Messages

Locked w/ New Messages Locked w/o New Messages

Locked w/o New Messages Post New Thread

Post New Thread